Glassnode Daten analyséiert vun CryptoSlate huet eng Divergenz tëscht Super Walen a Retail gewisen, mat deem fréiere bleift am aggressive Akkumulationsmodus an dat neit Joer.

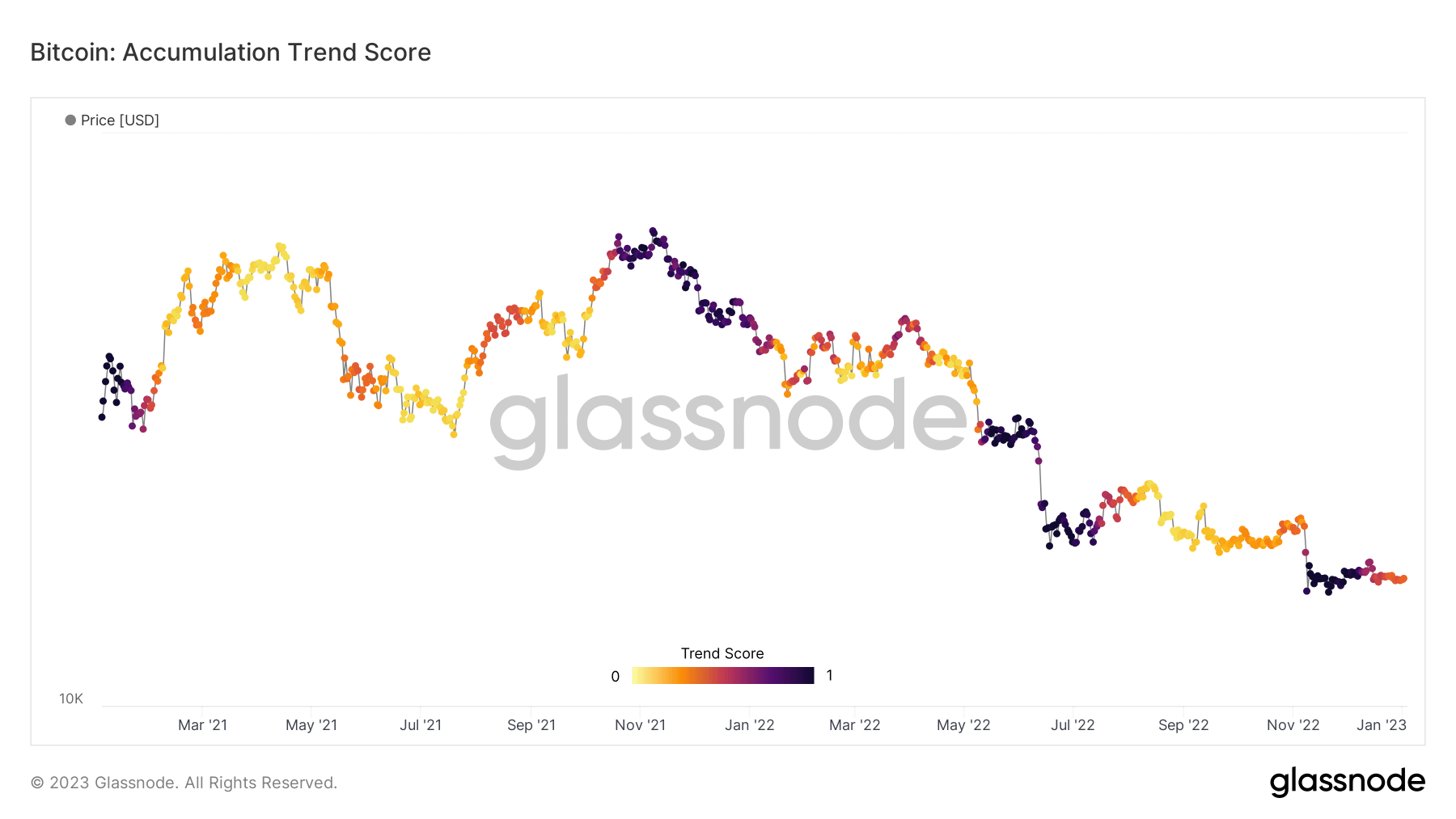

Bitcoin Akkumulation Trend Score

D'Akkumulation Trend Score (ATS) kuckt op d'relativ Gréisst vun Entitéiten déi aktiv hir Bitcoin Holdings sammelen oder verdeelen.

D'ATS Metrik benotzt e Spektrum tëscht 0 an 1. Eng Liesung méi no bei 0 weist d'Verdeelung oder de Verkaf un. Wärend e Score méi no bei 1 weist Akkumulation oder Kaaf.

Analyse vun der Grafik hei drënner huet gewisen datt substantiell Akkumulation wärend dem FTX Zesummebroch ronderëm fréi November 2022 geschitt ass, och wann de Bitcoin Präis negativ op d'Noriichte reagéiert huet.

Dëst hindeit datt d'Investisseuren, als Ganzt, Wäert gesinn hunn fir zu reduzéierte Präisser ze kafen.

The ATS has since turned more neutral, with distribution bias, reflecting lingering macro uncertainties going into 2023.

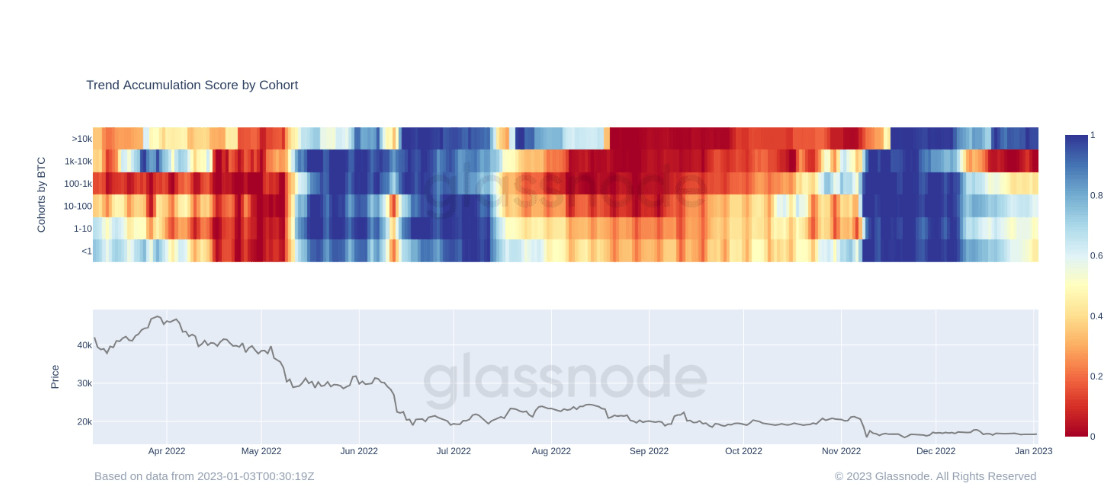

Kohort Analyse

Cohort analysis gives a graphical representation of accumulation and distribution across six cohorts, ranging from minnows with less than one BTC to super whales holding more than 10,000 BTC.

As the FTX saga was blowing up, all cohorts were accumulating aggressively. This consistent trend ended around mid-December 2022 when whales (entities holding between 1,000 and 9,999 BTC) began heavily distributing.

The change in whale sentiment spread across other cohort groups, which also began distributing, but not to the same extent as the whales. Conversely, throughout this period to the present, super whales remained net accumulators to a strong degree.

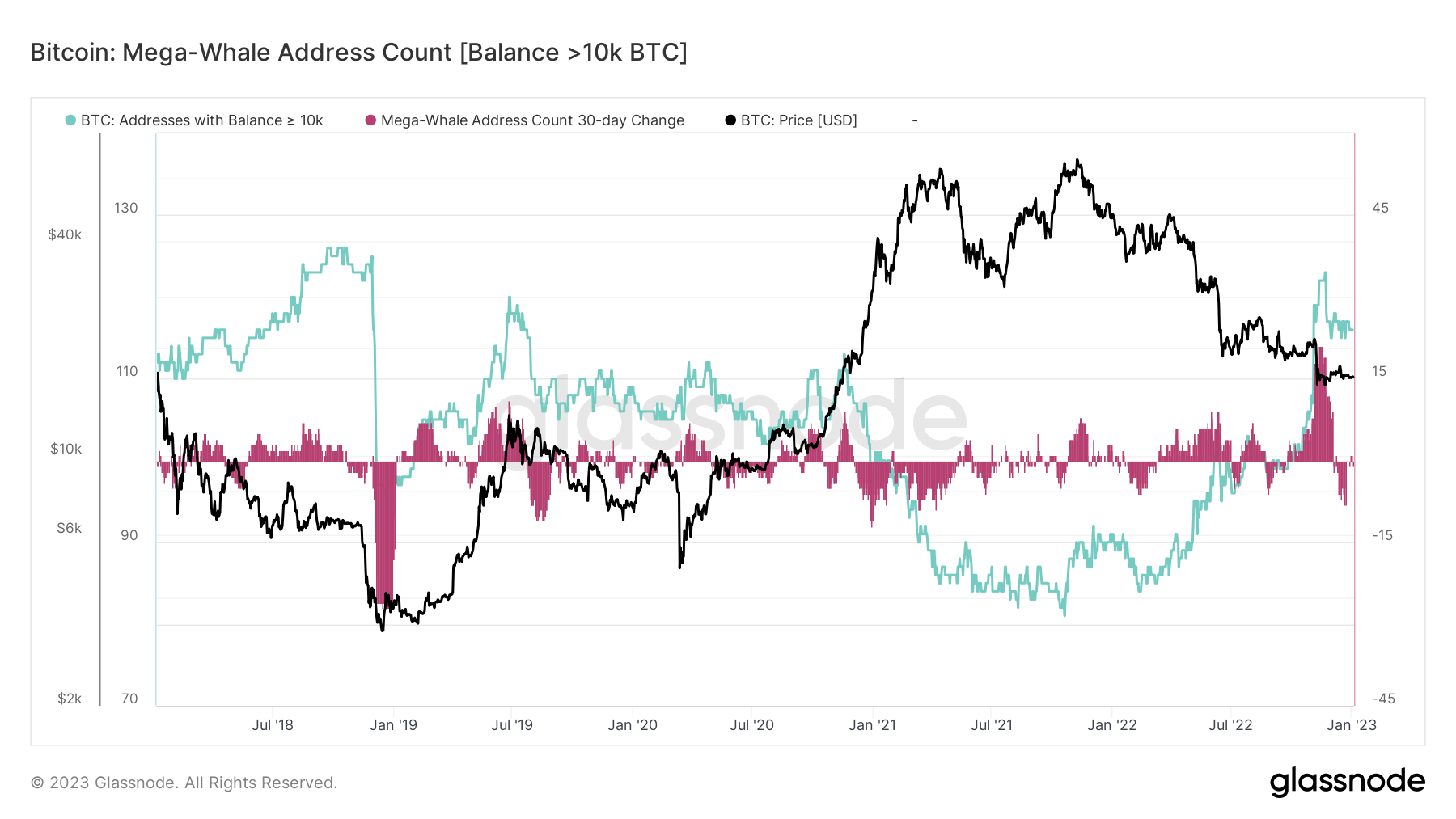

Mega-Whale Address Count

Analysis of the Bitcoin Mega-Whale Address Count Balance showed entities with more than 10,000 BTC surpassed 120 addresses at the tail end of last year. This encompassed a 30-day change of over 20 additional addresses, marking the fastest growth rate since 2018.

Coupled with the above charts detailing aggressive super whale accumulation, it’s fair to conclude smart money investors were buying the dip.

Source: https://cryptoslate.com/research-bitcoin-super-whales-remain-aggressive-accumulators-retail-sells/