“I’m part of the crypto skeptic community, I guess you’d say,” said economist Paul Krugman, opening a 30 minute-long conversation with Binance CEO Changpeng “CZ” Zhao produced for a new MasterClass course.

Krugman perhaps understates his position on cryptocurrency and blockchain, last week penning a New York Times KOLONN in which he says the hype over cryptocurrency and blockchain technology is a “tragedy” that has resulted in “waste on an epic scale.” He certainly made an ideal sparring partner to CZ for the online class. MasterClass provided Decrypt access to the fifth lesson, which featured the pair of experts.

“Our rap has always been that we can’t see what problem crypto is solving, what it really is doing that we aren’t already doing, or how it can—to the extent there is a problem—solve it better than other more conventional methods,” he said.

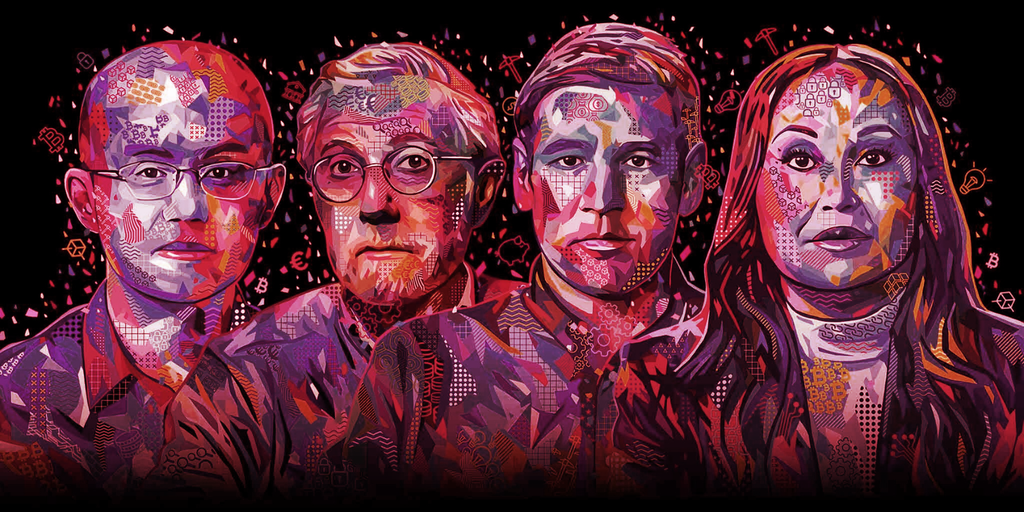

Ausbildung ass Schlëssel fir Adoptioun. Masterclass ass eng vun den engagéierendste Bildungsplattformen op der Welt. Ech hunn méi wéi 6 Stonnen fir dës ze schéissen, meeschtens well ech vill NG hunn. Och eng flott Plakat déi si gemaach hunn. Wierklech cool. 🙏 https://t.co/LMJ27cLpXU

- CZ 🔶 Binance (@cz_binance) Dezember 8, 2022

Zhao responded by pointing out that the original concept of Bitcoin and cryptocurrency was to provide a new way to transfer value, the same way that the internet is a new way to share information.

“Bitcoin, specifically, is a slightly better form of money—it fixes some of the problems we have with money today on limited supply, not easy to use, not a lot of freedom, and not very low fees,” Zhao said. “If you think about global commerce, international transfers, remittances, micropayments, et cetera.

“To be very frank with you, Bitcoin’s first use case was imagined to be payments, but it hasn’t taken off. But the other use cases have,” he continued.

CZ pointed to the ability of crypto to raise millions of dollars in funding and income streams for artists using non-fungible tokens or NFTs.

“It is global fundraising; It is much easier for entrepreneurs to raise money globally,” he said. “Using cryptocurrencies, a reputable entrepreneur can raise $10 to $20 million US dollars equivalent in crypto in a matter of days.”

Krugman remained skeptical.

“I’m a little puzzled—it’s not clear why blockchain should in itself make it any easier to raise money,” Krugman said, noting the idea may only appear to have merit because of the popularity of crypto.

"Ech denken, datt den Haapt groussen Ënnerscheed d'Grenzgrenze vun dëser Technologie ass," sot Zhao, zitéiert d'Schwieregkeet fir grenziwwerschreidend Bezuelungen mat traditionelle Banken ze maachen. "Blockchain bitt dat, an ech mengen dat ass den Haaptgrond."

The Binance CEO pointed to the global differences in economic opportunities, citing the vibrant economy of the United States versus China, Vietnam, and African countries.

“It’s very difficult for somebody outside of the U.S. to transfer money there because of the International SWIFT fees, et cetera,” Zhao said.

“But [that isn’t] not a technological issue, but a regulatory issue,” Krugman countered. “Isn’t it just basically just a way of sidestepping regulations that, for whatever reason, governments have thought were appropriate to put in place?”

Wärend Reglementer en Deel vum Thema sinn, sot den Zhao datt hie mengt datt et méi e Legacy Thema ass an en Thema mat den héije Käschte fir Suen vu Land zu Land ze schécken.

“There’s nothing regulatorily prohibiting us from investing in a project, for a person in Dubai to invest in a project in South Africa,” he said. “But the mechanics of doing that is very difficult for traditional financial services.”

Zhao said that because technology is making the world smaller, entrepreneurs can access a global liquidity pool using blockchain technology.

"Firwat net einfach d'Bankreegelen reforméieren?" De Krugman huet gefrot, de Problem mat Handyen ze vergläichen a wéi zwee US Carrièren ënnerschiddlech Politiken fir déiselwecht Regiounen hunn.

Krugman also questioned how long Bitcoin adoption has taken compared to innovations like the internet, saying that the argument that crypto is still new is getting old.

“If you want to compare it with the internet in 1995, by 2008, we were all living on the internet,” ” Krugman said. Bitcoin was created in 2009, 13 years ago.

Zhao acknowledged that Krugman made a good point but noted that the thing we now know as the internet was developed in the 1960s with the US Advanced Research Projects Agency Network or ARPANET, followed by the US military’s use of email in the 1980s.

"D'Thema schéngt mat Regierungen a Reglementer ze sinn anstatt d'Technologie," huet de Krugman geäntwert, a bemierkt datt hien e Glawe vu Krypto géif ginn, wann et him méi séier duerch d'Immigratioun kënnt wann hien an Europa reest. Hie weist op d'Liichtegkeet mat där Reesender, déi Global Entry benotzen, an d'USA erakommen, huet hien bäigefüügt, "De Problem ass datt se net iwwerdrobar sinn, a Blockchain wäert net hëllefen."

Many crypto enthusiasts point to the 2008 financial crisis as why Bitcoin and the industry it birthed are necessary. But many have questioned how practical it is to expect the average person to understand the technology and its financial implications.

“What is interesting is, after 2008 and all of those disasters, and we responded not with education, we responded with regulation, we responded with Dodd-Frank, with stuff that basically tried to bring more of the financial system under the umbrella of prudential regulations,” Krugman said.

“Wouldn’t the lesson from all of that be not to expect high school students to come out able to understand all of that stuff that you’re telling me about?” he asked.

“It’s not black and white,” Zhao responded. “I think, from a regulatory perspective, it is important for regulations to continue to evolve with new technologies, new industries, to protect consumers, I think that is needed.”

Zhao added that at the same time, people need to learn how to protect themselves.

“No solution is perfect. I’m not saying that education will solve all problems, [but it would] improve a little bit,” Zhao said.

De Krugman sot datt et eng graduell Expansioun vum Reguléierungsnetz wäert sinn, a bäigefüügt datt hien der Meenung ass datt déi meescht Krypto fir reglementaresch Evasioun an Vermeidung benotzt gëtt. Trotzdem, mengt hien, datt d'Krypto wäert iwwerliewen, "awer si wäerten net z'ënnerscheeden vun normale Finanzen."

Gegrënnt am 2004, MasterClass, ass eng amerikanesch Online Educatioun Abonnement Plattform déi Tutorials a Virliesunge viraus opgeholl vun Experten a verschiddene Beräicher ubitt. den "Crypto an de BlockchainMasterClass Cours enthält och Sessiounen gefouert vum Coinbase President a COO Emilie Choi a Chris Dixon, Generalpartner bei Andreessen Horowitz.

Bleift um Top vun der Krypto Neiegkeet, kritt alldeeglech Updates an Ärer Inbox.

Source: https://decrypt.co/116808/paul-krugman-cz-changpeng-zhao-masterclass