TL; DR Zerfall

- Solana price analysis suggests a downward movement to $11.00

- Deen nooste Supportniveau läit bei $ 11.80

- SOL Gesiichter Resistenz op der $ 12.00 Mark

d' Solana Präis analysis shows that the SOL price action has fallen below the $ 12.00 Mark and dropped to $11.80 under the bearish pressure.

The broader cryptocurrency market observed a bearish market sentiment over the last 24 hours as most major cryptocurrencies recorded negative price movements. Major players include BNB and ETH, recording a 2.33 and a 1.49 percent decline, respectively.

Solana price analysis: SOL struggling at $11.80

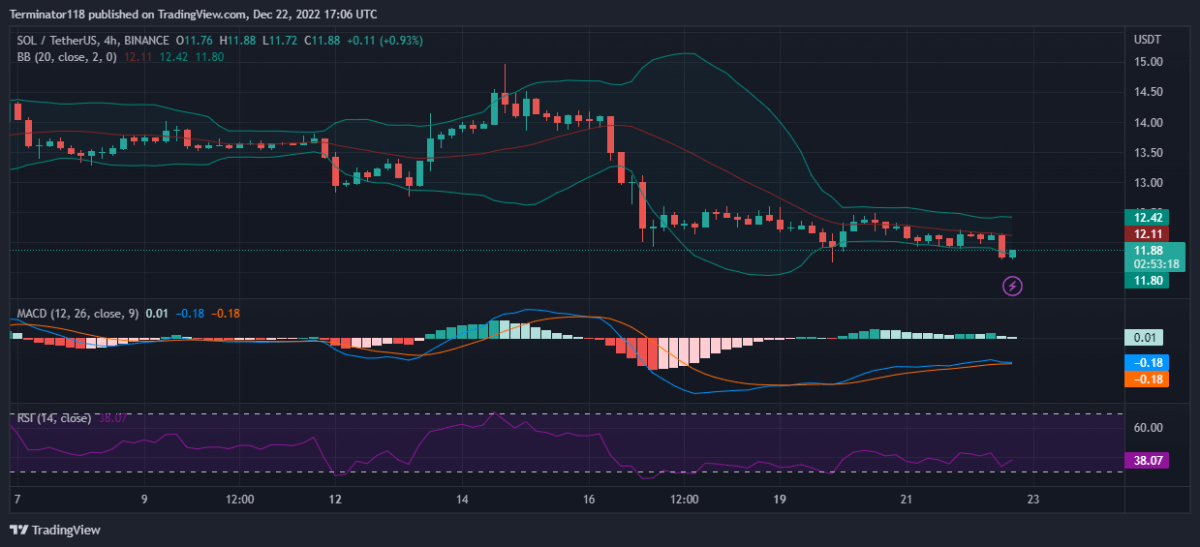

De MACD ass momentan bullish, wéi ausgedréckt an der grénger Faarf vum Histogramm. Wéi och ëmmer, den Indikator weist niddereg bullish Dynamik wéi an der niddereger Héicht vum Histogramm observéiert. Ausserdeem suggeréiert de méi hell Schiet vum Indikator datt de bullish Momentum ugefaang huet ze reduzéieren wéi d'Präisaktioun ëm d'$12.00 Mark konsolidéiert.

The EMAs are currently trading below the mean position as net price movement over the last ten days remains negative. However, the two EMAs are moving upwards suggesting a bullish correction in the markets. On the other hand, as the two EMAs converge, the bullish momentum dies down suggesting an increase in selling activity in the markets.

De RSI ass virun e puer Deeg kuerz an d'Iwwerverkaafsregioun gefall, awer séier erëm opgestallt a weider an der neutraler Zone gehandelt bis d'Presszäit. Elo handelt den Index um 38.07 Eenheetsniveau mat engem horizontalen Gradient. Den Indikator gëtt am Moment kee Signal eraus, während den nidderegen Hang e Manktem u Dynamik op béide Säiten suggeréiert, wat op eng geréng Volatilitéit iwwer kuerzfristeg hinweist.

The Bollinger Bands were expanding to facilitate the volatile movements but narrowed as the price stabilized at the 12.00 mark. Since then, the bands started to converge as the volatility died down in the struggle for dominance. At press time, the indicator’s bottom line provides support at $11.80 while the upper limit presents a resistance level at the $12.42 mark.

Technesch Analysë fir SOL/USDT

Overall, the 4-hour Solana price analysis issues a strong sell signal, with 15 of the 26 major technical indicators supporting the bears. On the other hand, only three of the indicators support the bulls showing a low bullish presence in recent hours. At the same time, eight indicators sit on the fence and support neither side of the market.

The 24-hour Solana price analysis shares this sentiment and also issues a sell signal with 14 indicators suggesting a downward movement against only three of the indicators suggesting an upwards movement. The analysis shows bearish dominance across the mid-term charts while significant buying pressure exists for the asset across the same timeframe. Meanwhile, nine indicators remain neutral and do not issue any signals at press time

Wat erwaart Dir vun der Solana Präisanalyse?

The Solana price analysis shows that strong bearish momentum enabled the bears to cause a price drop to the $12.00 mark. However, the bulls found support at the level that enabled them to stabilize the price action. Regardless, the bearish pressure rose once again as the price fell to $11.80 before recovering to $11.88 again

Traders should expect SOL to observe a downward breakdown as the price falls down to the $11.00 support level. The suggestion is supported by the mid-term technicals which are highly bearish suggesting strong downward movement. SOL can be expected to drop to $11.00 mark before stabilizing at the level.

Quell: https://www.cryptopolitan.com/solana-price-analysis-2022-12-22/