No enger brutaler Sequenz vun Eventer déi zum Zesummebroch vu verschiddene Krypto-verbonne Firmen am Joer 2022 gefouert huet, huet d'FTX Insolvenz e massive Schlag fir d'ëffentlech Vertrauen an zentraliséierter Krypto-Entitéite gemaach.

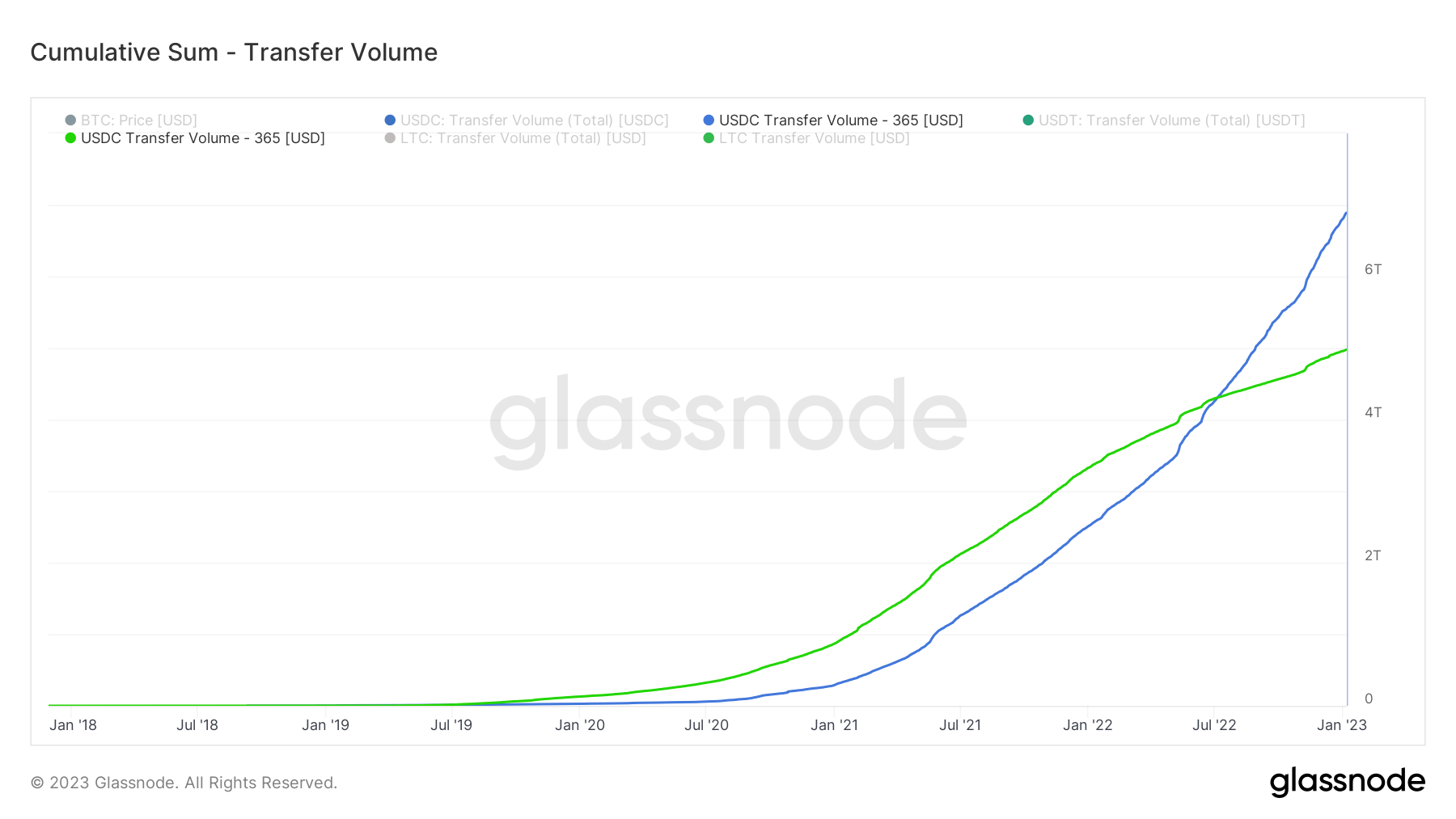

Wärend dëser Period vun der verstäerkter Maartvolatilitéit hunn Krypto-Investisseuren d'Circle's USD Coin (USDC) op Tether's USDT léiwer. Laut Glassnode Daten, während USDT de gréisste Stablecoin no Maartkapp ass, huet USDC méi Transfervolumen.

Geméiss den Donnéeën huet USDC en Transfervolumen vun $ 15 Milliarde, während dem USDT Volumen $ 3 Milliarde ass. Kumulativ iwwerschreift USDC USDT ëm $7 Billioun.

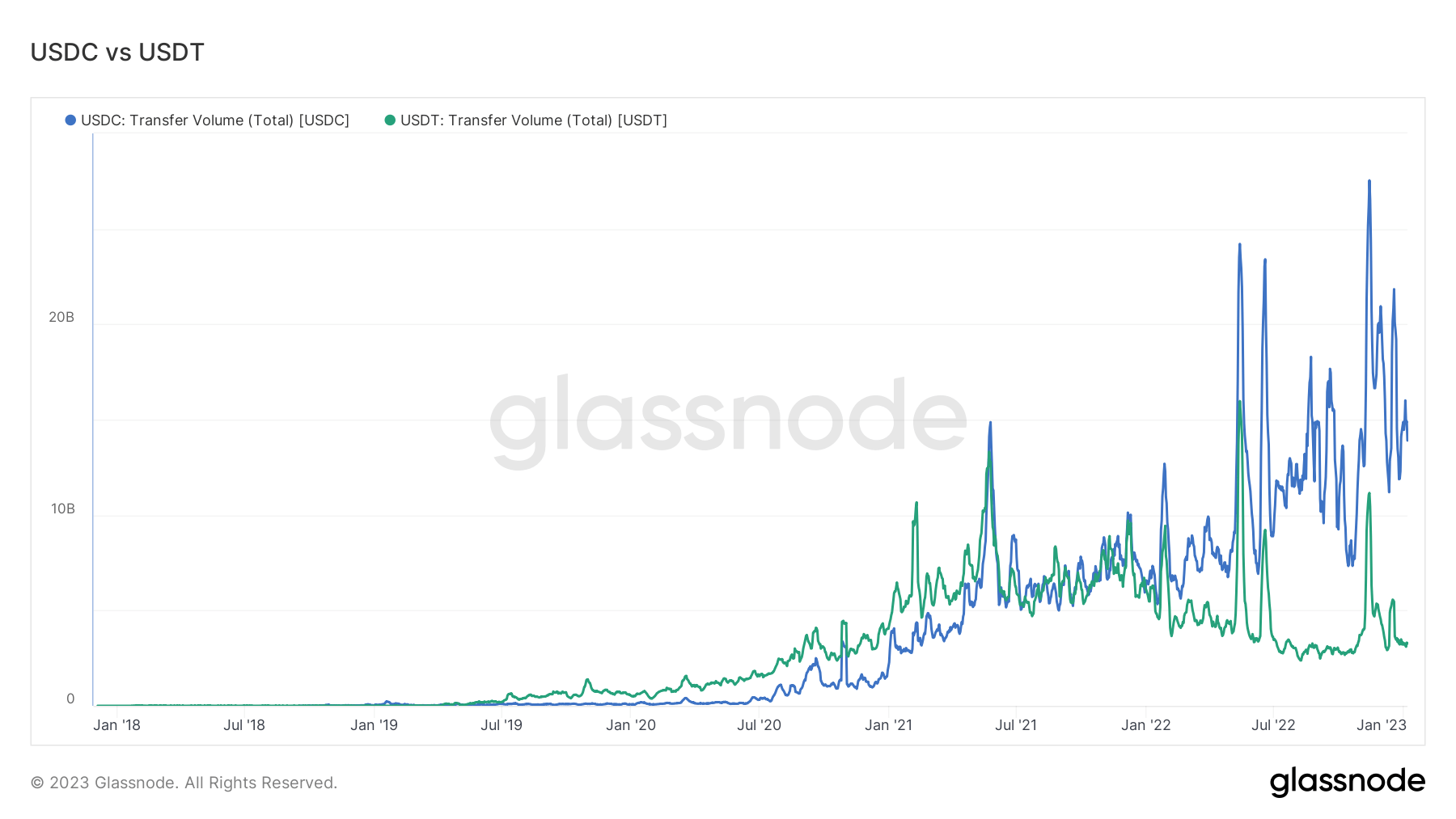

Meanwhile, the Glassnode chart below shows that the disparity in transfer volume was not always like this. USDT’s volume outperformed that of USDC in 2020 and early 2021. But that changed in 2022 when the Circle-backed stablecoin’s volume started growing.

At the time, USDT began to face increased reglementaresche Kontroll about its reserves coupled with Terra’s LUNA collapse, which birthed fears of whether the stablecoin wouldn’t lose its Dollar peg.

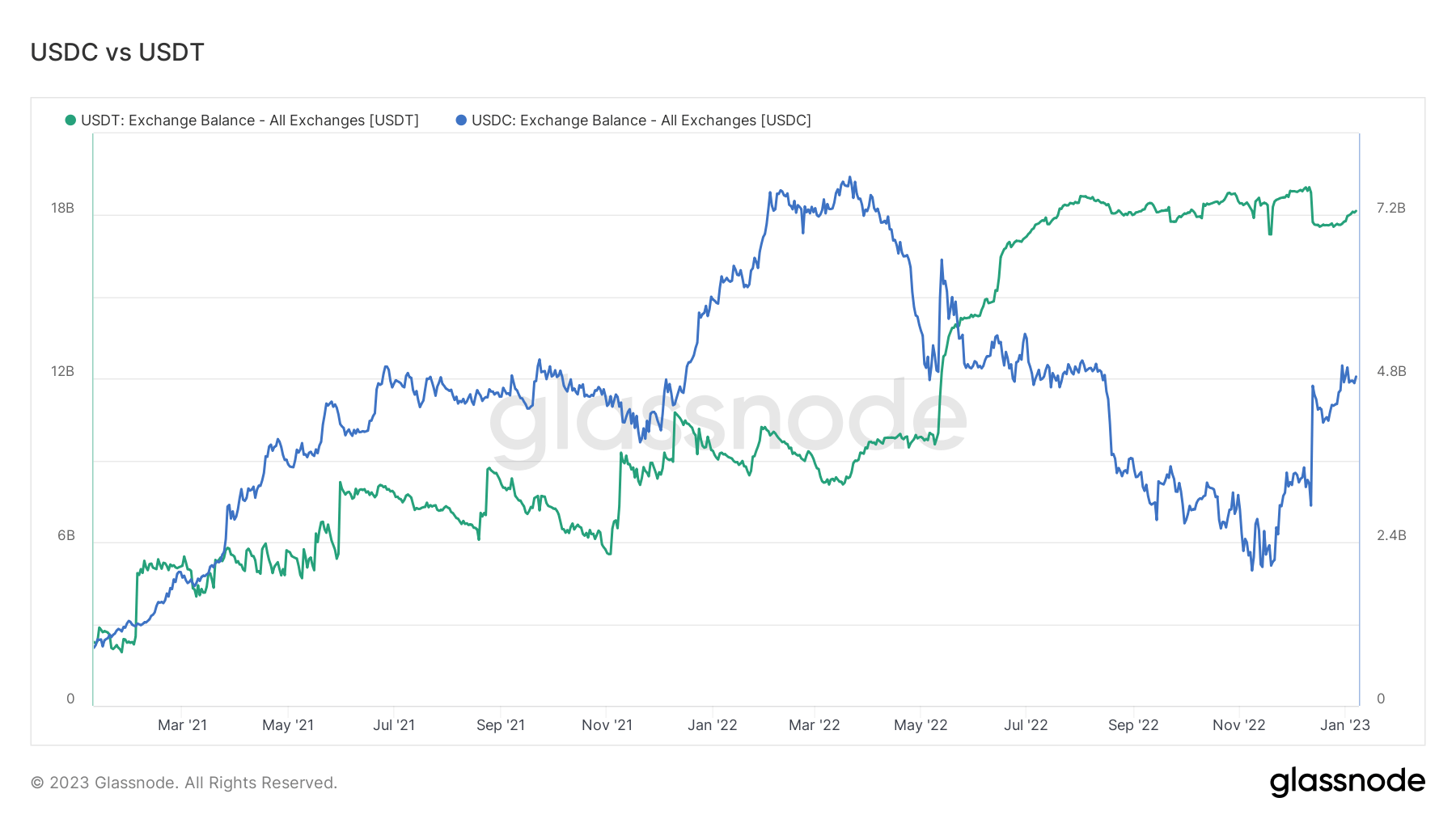

USDC’s balance on exchanges reach $5 billion

In terms of exchange balances, Glassnode data shows that USDC is beginning to enjoy more adoption post-FTX collapse. According to the data, the USDC on exchanges is approaching $5 billion.

Previously, USDC’s adoption in 2022 had declined thanks to Binance’s decision to convert its users’ balances in USDC and other stablecoins to its BUSD. However, with the FTX collapse birthing FUD that led to record withdrawals from Binance, USDC’s adoption began to see an hëlt Richtung Enn vum Joer.

Besides that, Coinbase also gefuerdert its users to convert their USDT to USDC for free.

On the other hand, USDT’s balance on exchanges stayed flat throughout the period –it even saw a slight decline in early January 2023.

Post FTX’s crash, USDT has seen more Froen raised about its reserves, with several hedge funds shorting the stablecoin. However, its issuer gesot Tether would continue to show resilience even in the face of uncertainty.

With 2023 set to be a risk-off year, the market could likely see further growth among stablecoins. This could set the stage for a fight for dominance between USDT and USDC.

Source: https://cryptoslate.com/research-usdc-adoption-grows-post-ftx-collapse-usdt-remains-flat/