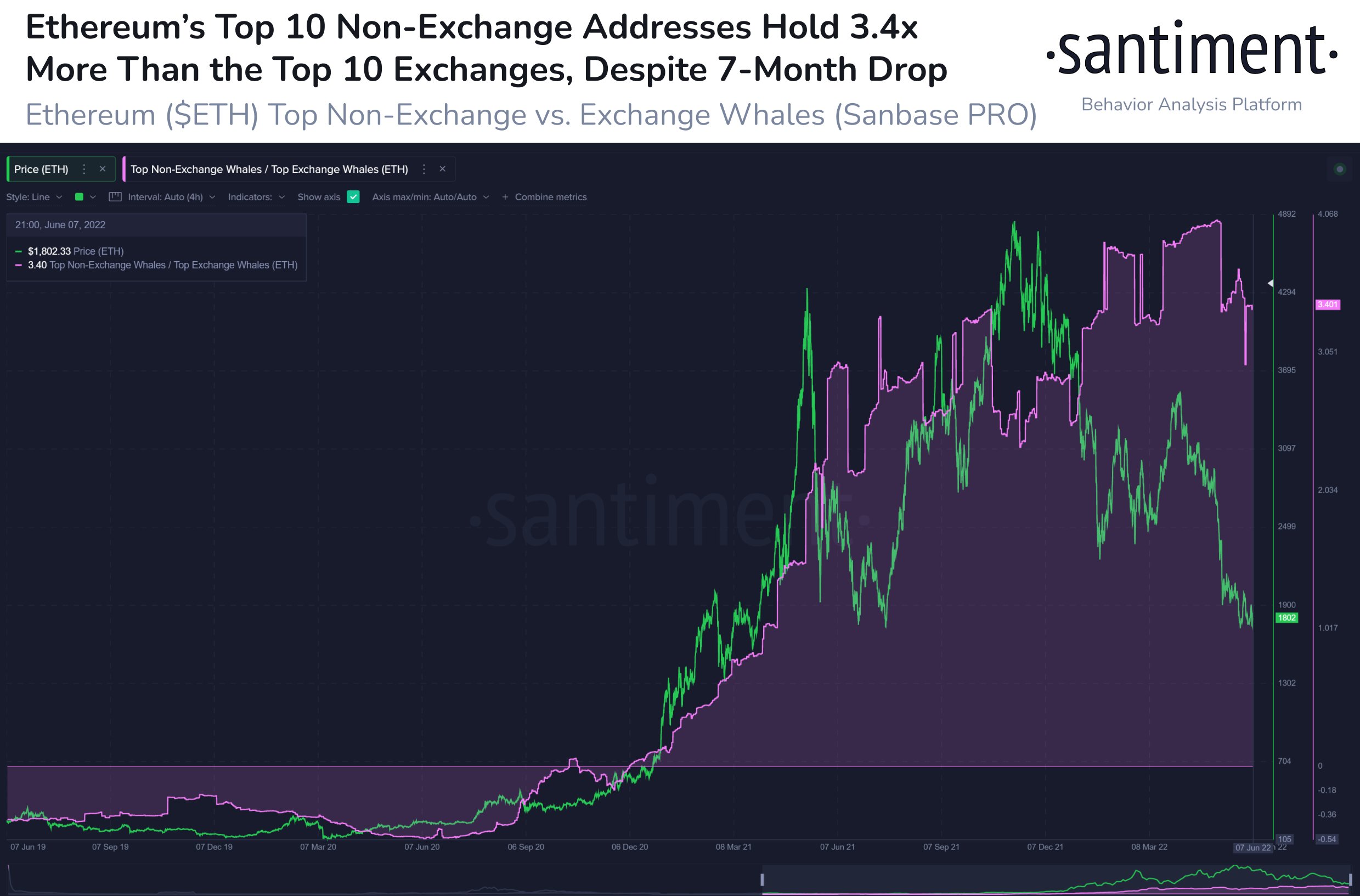

Analytics firm Santiment says the world’s most affluent crypto investors remain bullish on Ethereum (ETH) despite the downturn in the market.

According to Santiment, the top 10 non-exchange wallets maintain a high ratio of Ethereum in their portfolio and now hold 3.4 times more ETH than exchanges.

D 'Firma seet this suggests the largest whales are keeping a firm grip on the leading altcoin.

Zu der Zäit vum Schreiwen, Ethereum ännert Hänn fir $ 1,778.

“Ethereum’s top 10 non-exchange vs. exchange addresses are maintaining a high ratio of ETH owned over the top 10 non-exchange whales. With a tremendous 3.4x more coins held, there still appears to be a belief that prices can stabilize.”

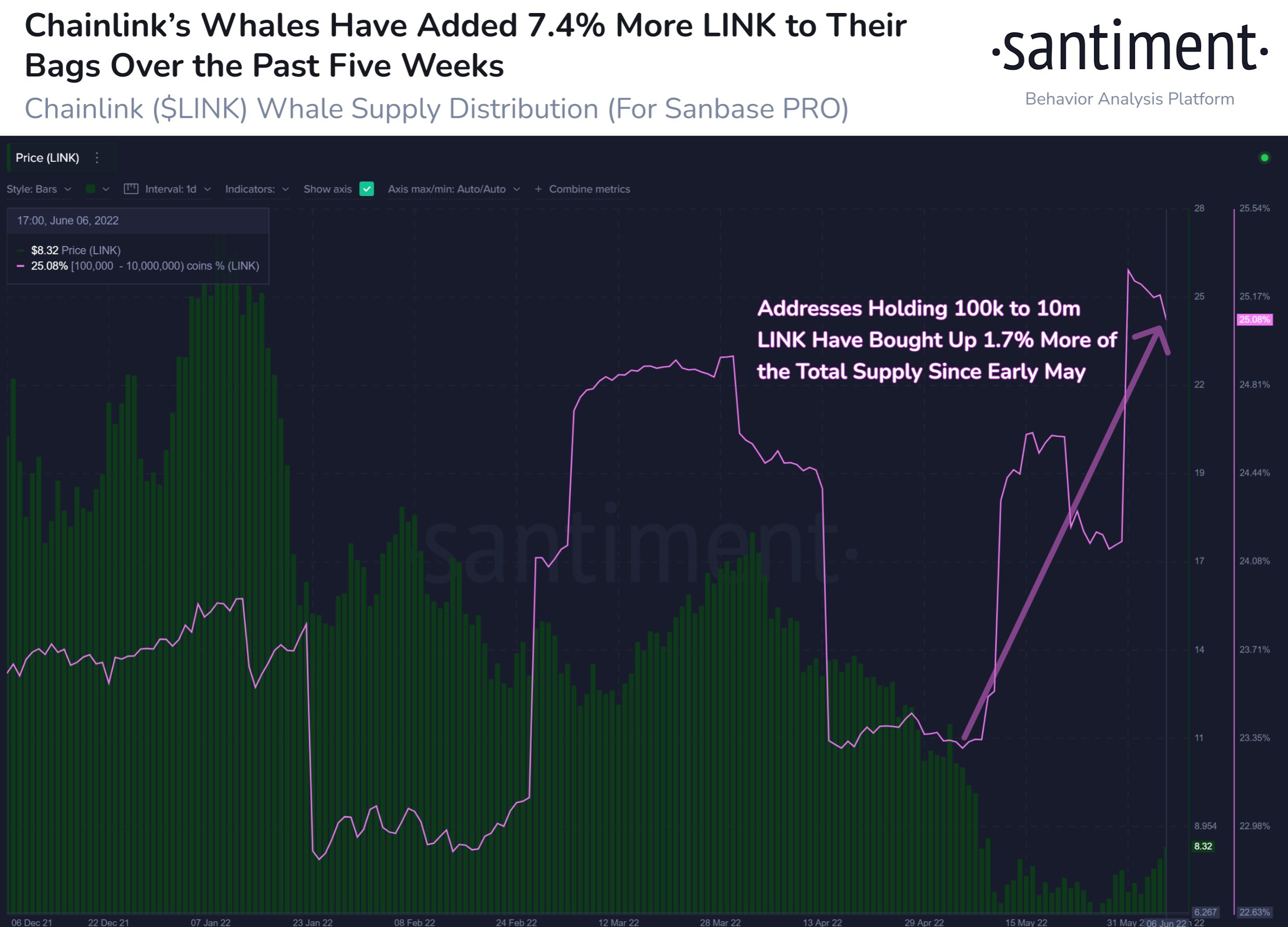

Santiment och seet deep-pocketed investors are accumulating Chainlink (LINK). The firm says whales have been stocking up the asset since last month when the price of the decentralized oracle network plunged to less than $6.00.

Zu der Zäit vum Schreiwen, Chainlink is trading for $9.35, up by 6.98% over the last 24 hours.

“Chainlink has pumped +9% in the past 2 hours, and accumulating whales are capitalizing. After dumping began on March 30th, they began accumulating again after prices dropped in early May. They hold 25%+ of the supply for the 1st time since November.”

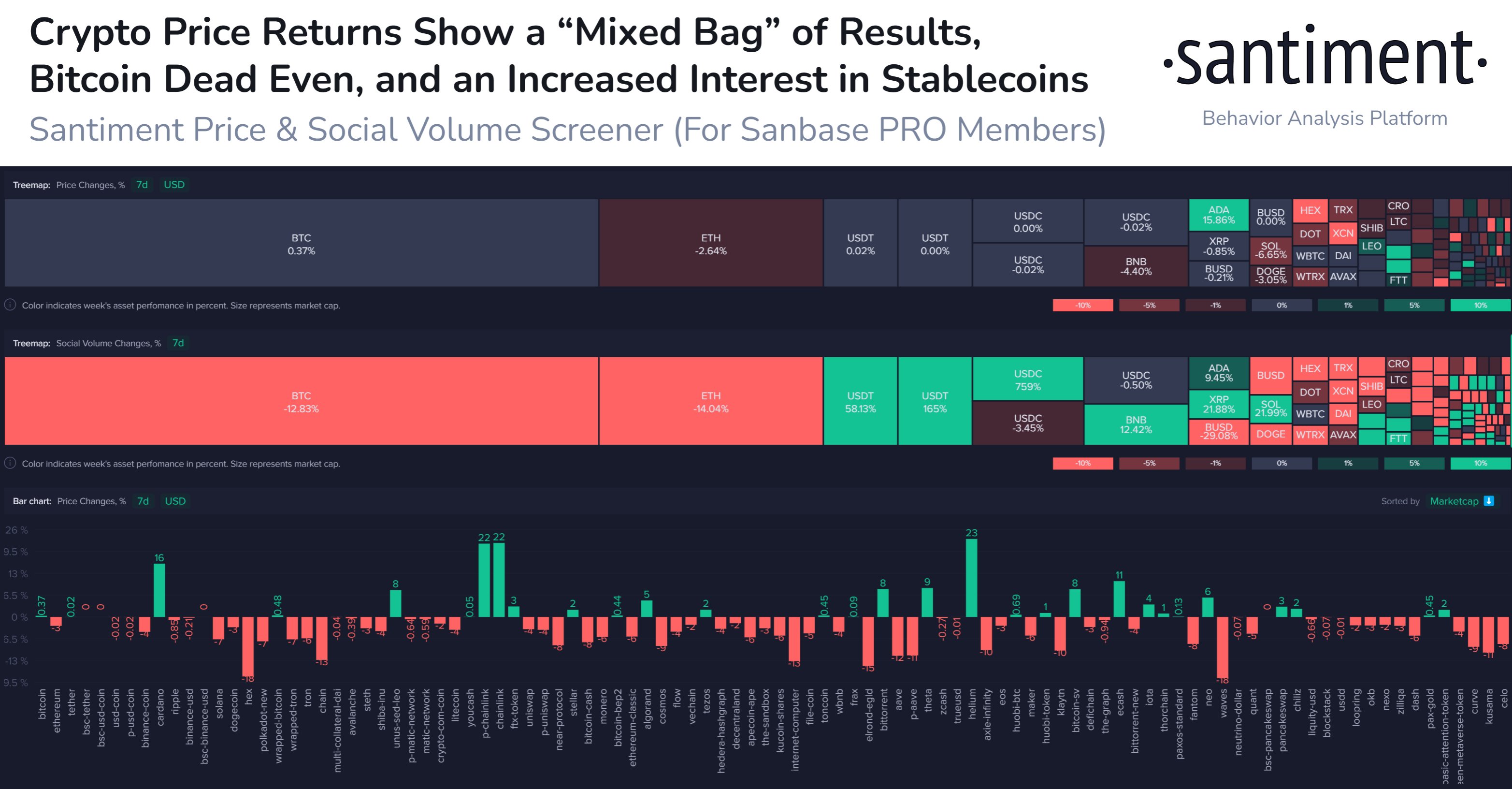

D'Analytikefirma seet LINK, along with Kardan (ADA) an Helium (HNT), are performing well despite the high volatility of the crypto market in early June. Meanwhile, the prices of geschriwen (BTC) and Ethereum are still moving sideways.

“Crypto prices chopped wildly in the opening week of June, but the result has been mainly no movement for Bitcoin and Ethereum. Altcoins, on the other hand, have shown major decouplings from one another, with ADA, LINK, and HNT performing well.”

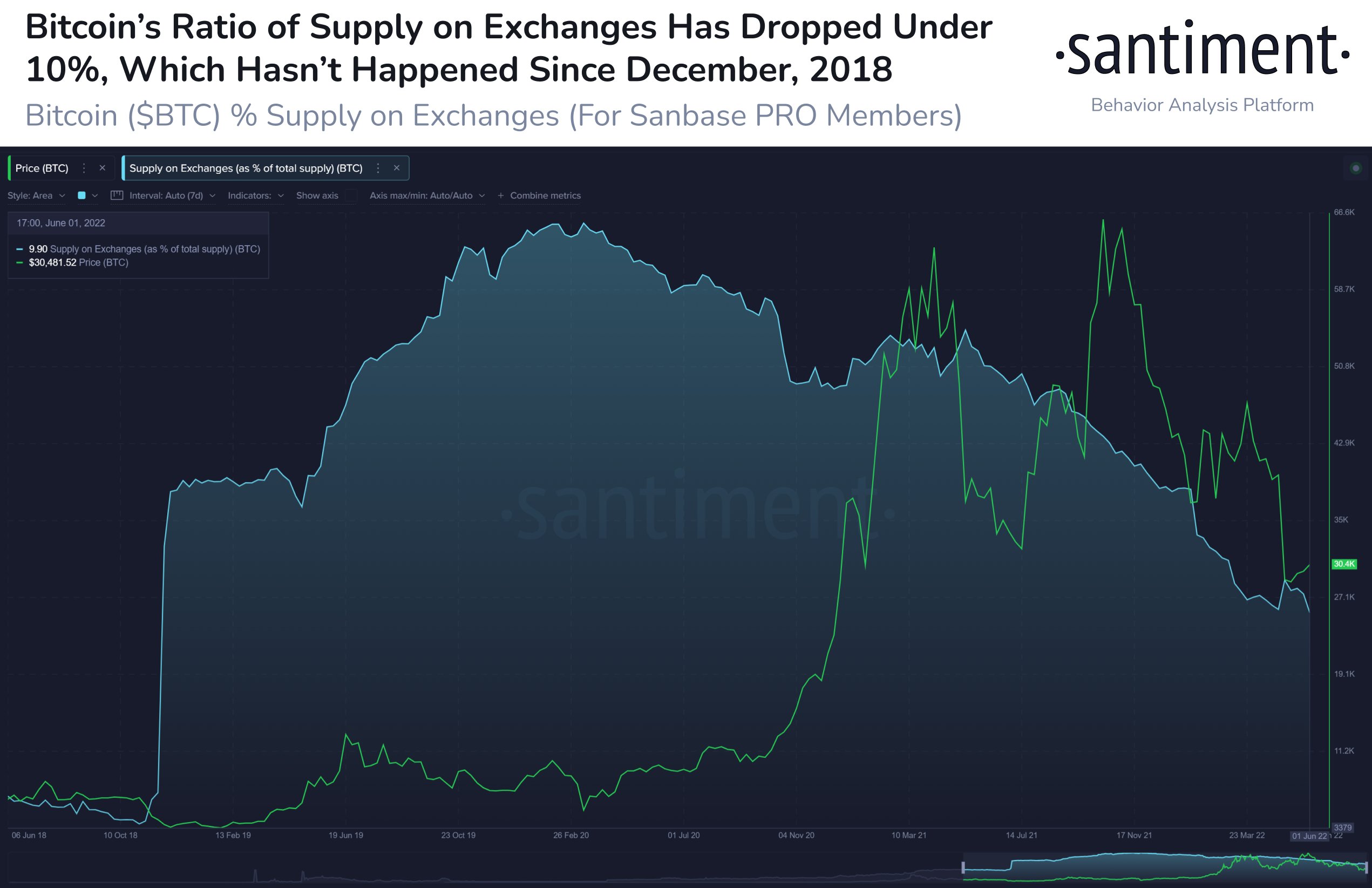

Santiment och verréid the ratio of the Bitcoin’s supply on exchanges is now at 10%, the lowest since December 2018, which could be a sign of a bullish stance among long-term holders.

“The percentage of Bitcoin’s supply sitting on exchanges is down to 9.9% after May’s volatility caused an influx of BTC moving to exchanges for panic sells. This is a sign of hodler confidence, and exchange supply hasn’t been this low in 3.5 years.”

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock / Tithi Luadthong

Source: https://dailyhodl.com/2022/06/10/top-crypto-whales-keep-a-firm-grip-on-ethereum-eth-while-accumulating-one-top-25-altcoin-analytics-firm/