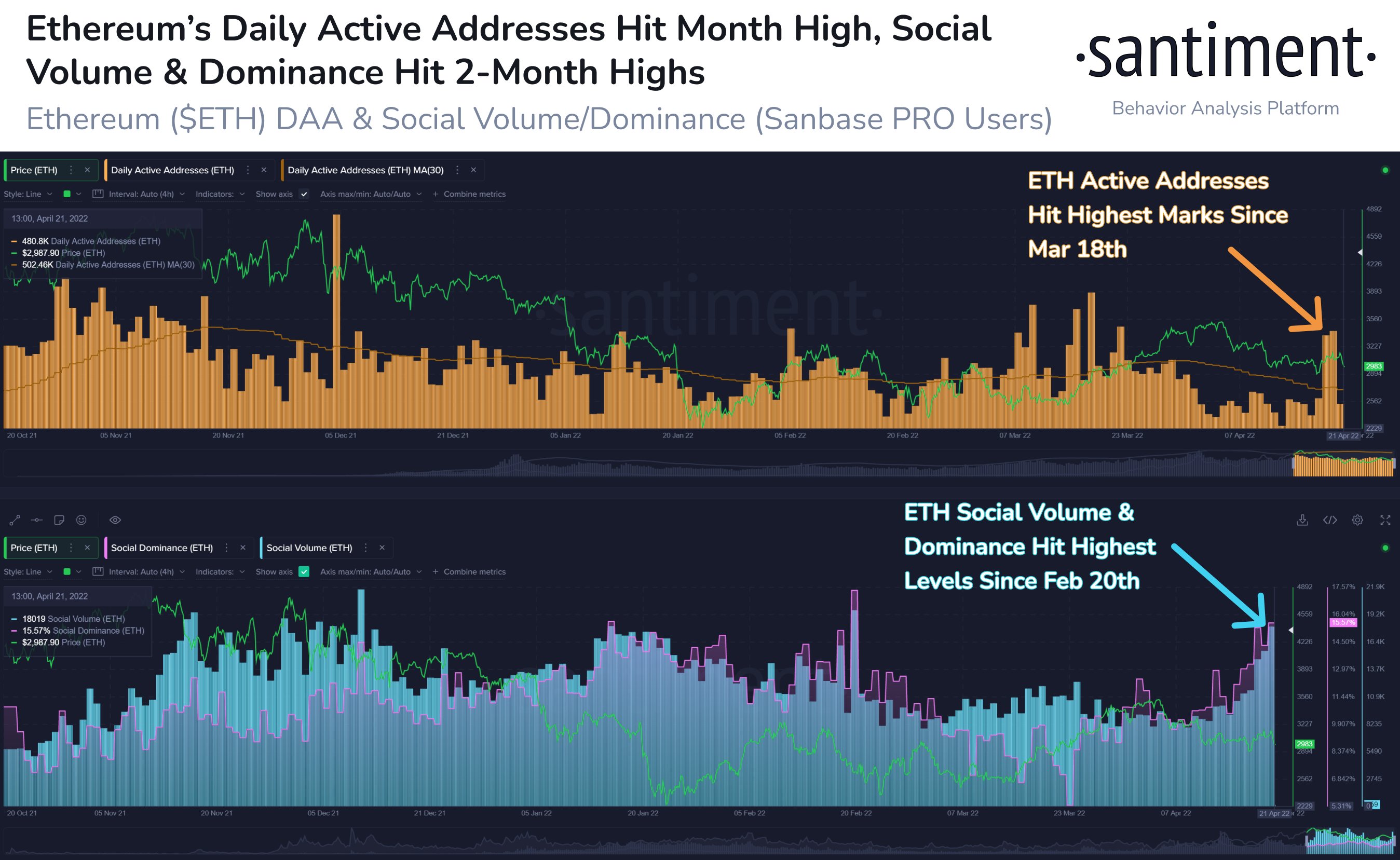

A leading crypto analytics firm says that the address activity on Ethereum is surging despite ETH’s recent sideways price movement.

An engem neien Tweet, Santiment Notizen that ETH’s daily active address total hit 592,000 on Wednesday, the highest amount since March 18th.

“Ethereum’s address activity really picked up this week, with Wednesday’s 592k addresses being the highest number of unique interactions in over a month.”

Discussion of Ethereum on social media this week also hit its highest level in two months, according to the analytics firm.

ETH is trading at $2,960.14 at time of writing after hitting a weekly high of $3,167.64 on Thursday. The leading smart-contract platform is down 2.8% in the past week and 2.3% in the past 30 days.

Lucas Outumuro, the head of research at blockchain intelligence firm IntoTheBlock, says in a new Blog Post that ETH printed nearly $800 million worth of net outflows in the past week.

According to the analytics firm, the metric is calculated by subtracting the net inflows from the net outflows over a seven-day period.

Exchange outflows can signal an accumulation phase, according to Outumuro.

Conversely, the crypto researcher also says Ethereum recorded about $97.3 million in accrued fees, a 14% decrease compared to the week before.

Fee totals track “the willingness to spend and demand to use” Ethereum, explains Outumuro.

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock/Katynn/monkographic

Source: https://dailyhodl.com/2022/04/23/ethereum-eth-witnessing-surging-activity-amid-price-stagnation-according-to-crypto-analytics-firm-santiment/