A widely followed analyst and trader says that the crypto market could copy its 2018 playbook.

Pseudonym Händler Altcoin Sherpa erzielt his 175,700 Twitter followers that this year “could very well” turn out to be a repeat of 2018 with a few differences with regard to infrastructure and diversity of digital assets.

“2022 could very well look like 2018 given the amount of time we could chop around for. I do think that the market is more mature these days than before, though. Overall market structure for trading is better + dexes [decentralized exchanges] + NFTs [non-fungible tokens] + gaming + new usable chains.”

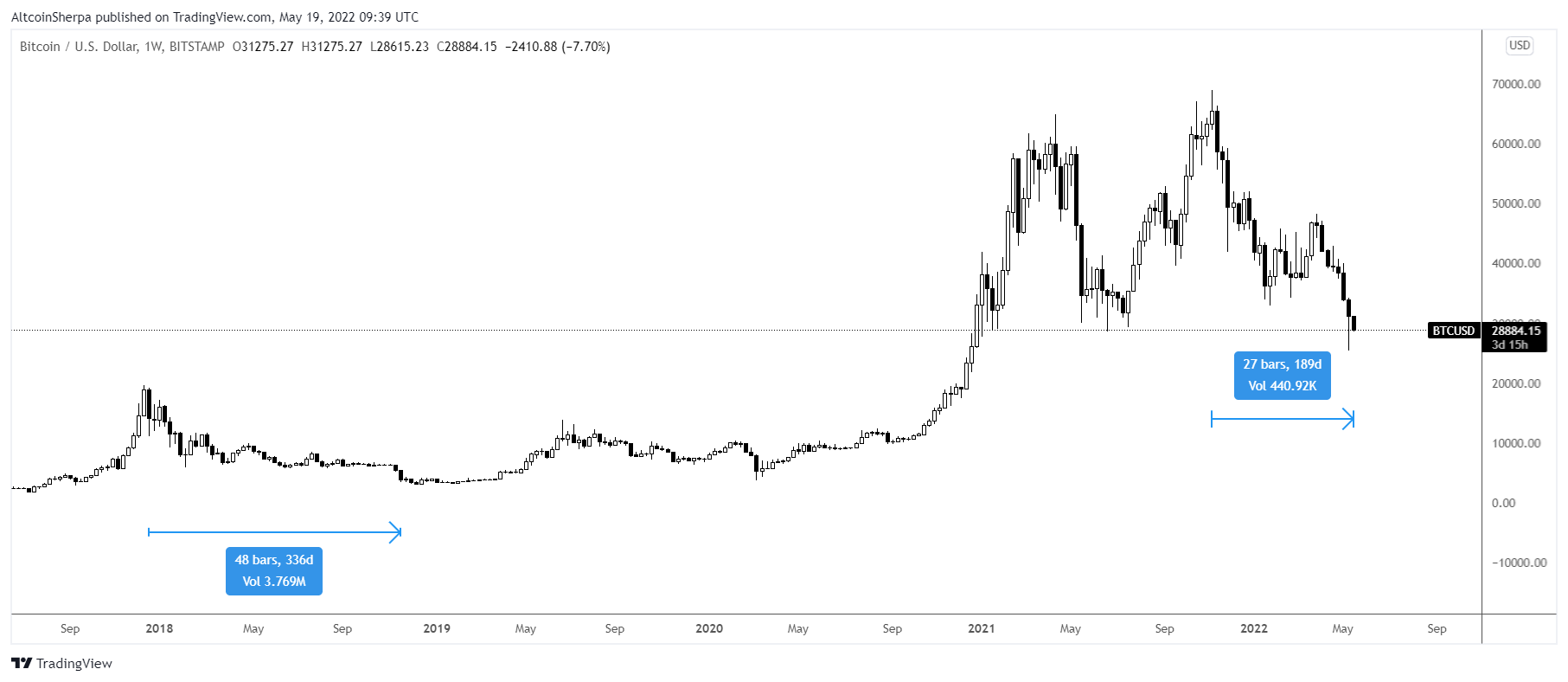

According to Altcoin Sherpa, Bitcoin (BTC) took 336 days in 2018 to hit a bottom after reaching a 2017 high, while altcoins took longer.

De Krypto Analyst an Händler seet that since Bitcoin hit the all-time high in November of 2021, roughly 189 days have passed, or about half the time it took for the flagship cryptocurrency to bottom out during the 2018 bear season.

“BTC: One thing that sucked about 2018 was the amount of time it took to drawdown; we’re about halfway there right now.

If you count altcoin/BTC pairs, it was even longer. 2019 was shit for many of those (alt/BTC pairs were more popular back then).”

The pseudonymous crypto analyst seet Bitcoin could appreciate by over 15% from current levels before crashing.

“Something like this would make sense for me; more people getting bullish on the bearish retest of $35,000 – $40,000 and then price nuking lower.”

geschriwen ass am Moment vum Schreiwen fir $ 29,504 gehandelt.

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Ausgezeechent Bild: Shutterstock / Natalia Siiatovskaia / Tithi Luadthong

Source: https://dailyhodl.com/2022/05/20/trader-predicts-crypto-market-will-mimic-2018-bear-season-heres-how-high-bitcoin-could-go-before-nuking-lower/