A leading digital assets manager says large, institutional investors are short-selling king crypto Bitcoin (BTC) at record rates.

Am leschten Digital Asset Fund Flows Weekly Rapport, CoinShares finds that institutional investment into short Bitcoin (BTC) products broke a record last week.

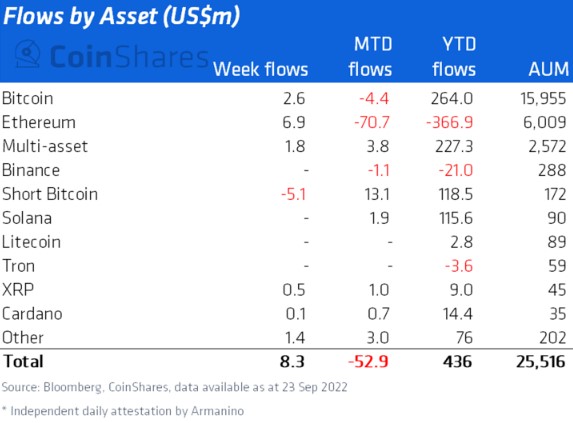

“Short-bitcoin investment products AuM [assets under management] rose to $172 million, the highest on record, prompting some profit taking with the first outflow in 7 weeks totaling $5.1 million.”

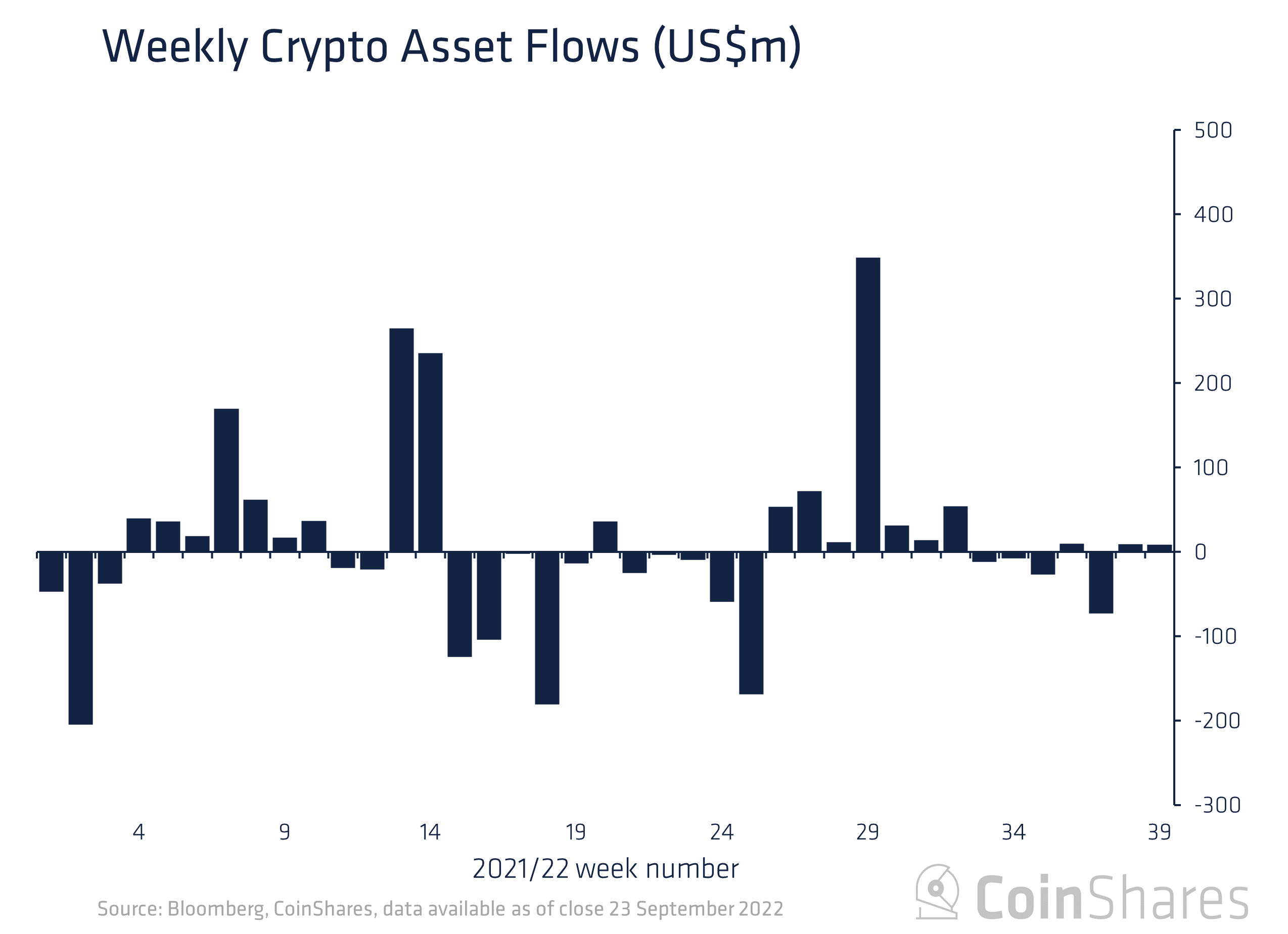

Overall, crypto investment products saw $8.3 million in inflows last week, showing that institutions currently have a “tepid” appetite for the markets, according to CoinShares.

While the US markets saw nearly $10 million in outflows, the European markets saw $15 million in inflows.

While BTC had small inflows of $0.1 million, Ethereum (ETH) investment products took in $7 million in institutional investments last week.

“Investors dipped their toes into Ethereum which saw inflows totaling $7 million last week, the first positive sentiment after the successful merge and following a 4-week run of outflows. The recent launch of a short-Ethereum investment product saw minor inflows totaling $1.1 million.”

Kosmos (Atom) investment products raked in $0.4 million, XRP products took in $0.5 million, and multi-asset investment products, those investing in a basket of cryptos, took in $1.8 million last week.

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

kontrolléieren Präis Action

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Generéiert Bild: DALLE-2

Source: https://dailyhodl.com/2022/09/26/institutional-investors-short-selling-bitcoin-btc-at-highest-rate-on-record-coinshares/