Institutional investors took advantage of last week’s Bitcoin sell-off in record numbers for 2022, according to CoinShares.

Am leschten Digital Asset Fund Flows Weekly Rapport, CoinShares finds that crypto investment products saw the largest capital inflow of the year last week as institutions sought to buy into the market’s weakness.

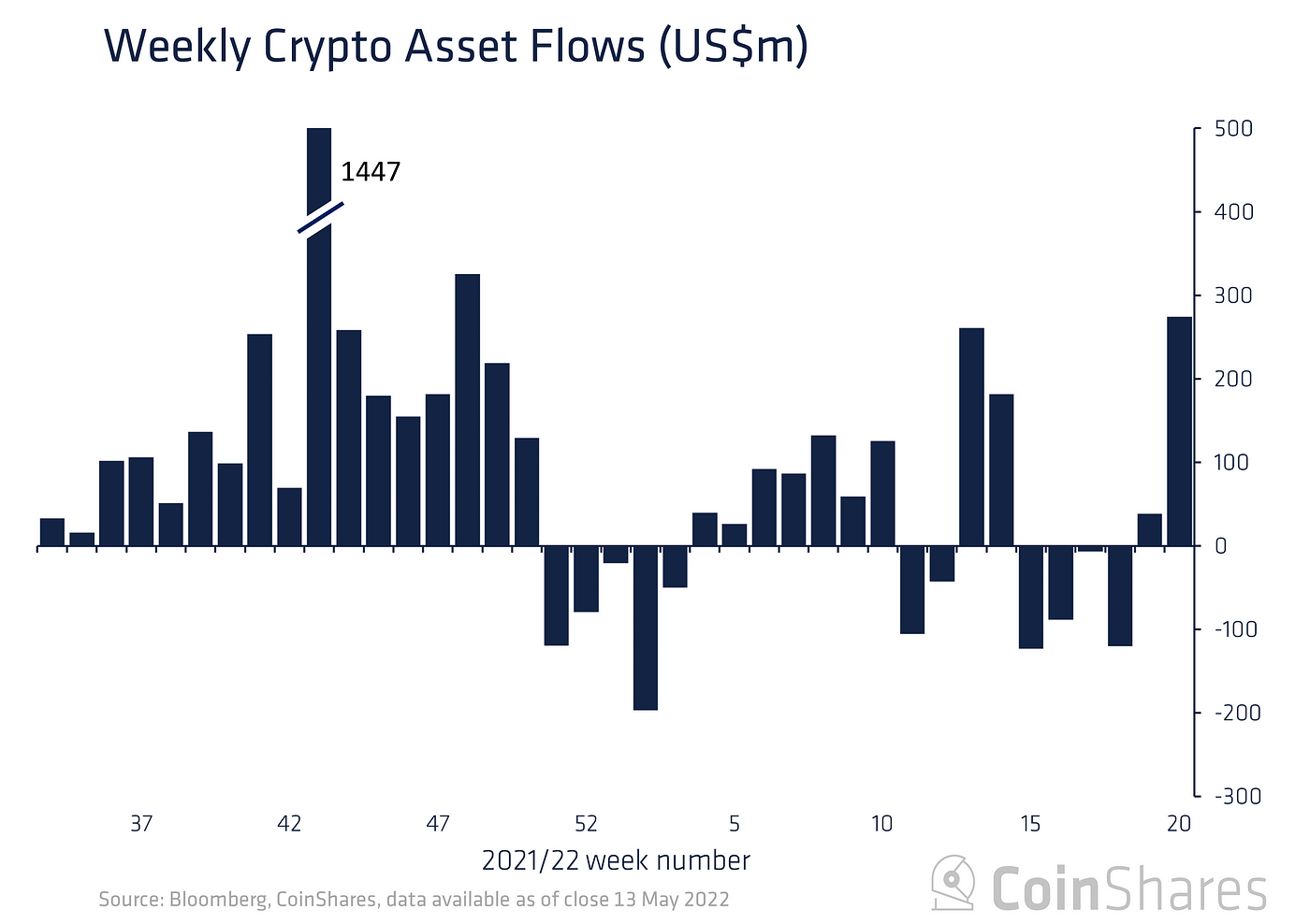

“Digital asset investment products saw record weekly inflows for this year, totaling $274 million last week.

A strong signal that investors saw the recent UST stable coin de-peg and its associated broad sell-off as a buying opportunity.”

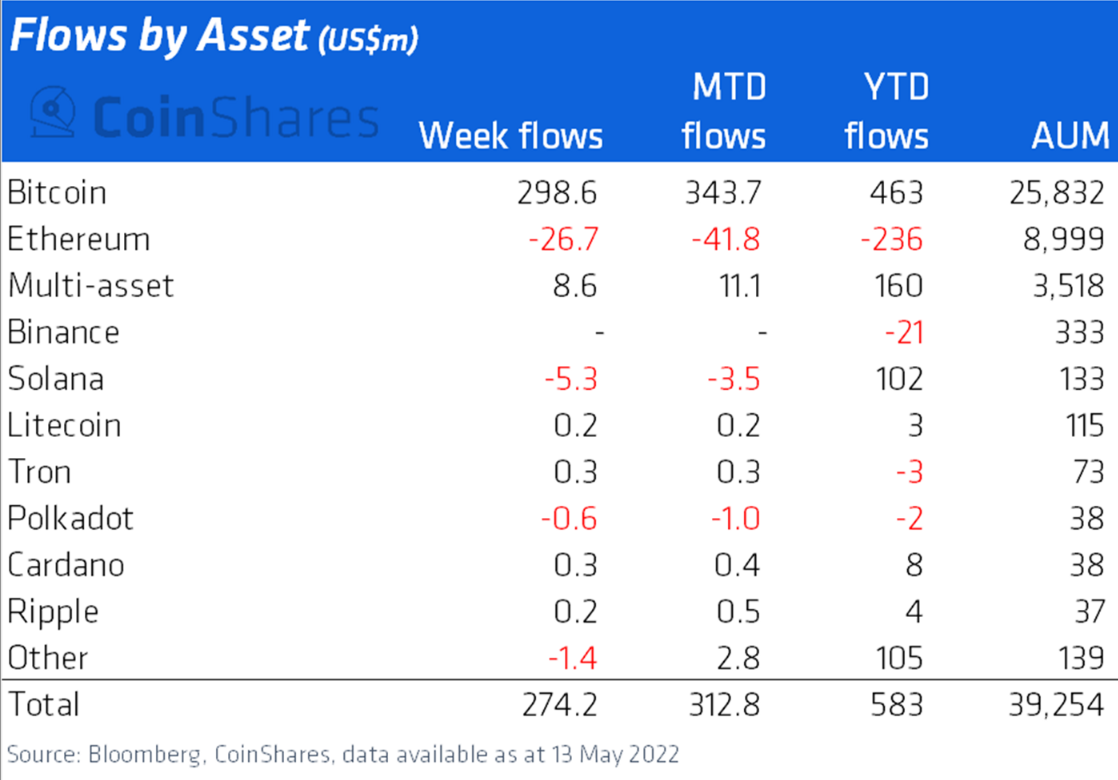

Bei wäitem, geschriwen (BTC) witnessed the largest amount of inflows from institutional investors last week, totaling $298 million.

As they have for most of 2022, Ethereum (ETH)-focused investment products saw more outflows last week, totaling $27 million, bringing ETH’s total yearly outflows to $236 million.

Multi-asset digital investment products, or those investing in more than one crypto, took $8.6 million of inflows last week while XRP, Kardan (ADA) Litecoin (LTC) an Tron (TRX)-focused investment products all saw less than $0.5 million in inflows a piece over the same period.

Even though TerraUSD (UST) lost its US-dollar peg last week, CoinShares still found that a small number of investors added to their Terra (LUNA) positions during the ecosystem’s fallout.

“UST, the stable coin at the epicenter of this recent price correction, saw AuM [assets under management] fall by 99% over the week, despite this some intrepid investors added $0.043 million to positions.”

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock/Sagi Agung W/Mingirov Yuriy

Source: https://dailyhodl.com/2022/05/16/institutional-investors-accumulate-staggering-298000000-in-bitcoin-as-ethereum-solana-and-additional-altcoins-tread-water-coinshares/