Fidelity’s director of global macro Jurrien Timmer is updating his long-term forecasts for Bitcoin (BTC) as the leading crypto asset by market cap struggles near the $30,000 mark.

An enger laanger Fuedem, Timmer makes reference to quant analyst PlanB’s once popular stock-to-flow model (S2F), which attempted to predict the price of Bitcoin based on supply shocks stemming from BTC halvings.

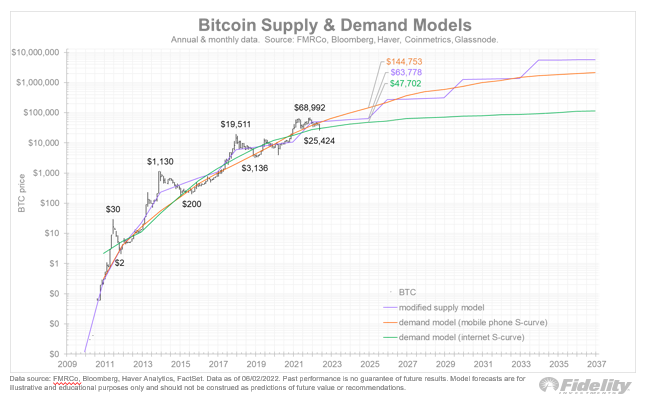

Timmer presents an S2F-inspired supply model, plus two more models that track the adoption rates of the internet and mobile phones.

According to Timmer’s modified supply model, geschriwen could be somewhere around $63,778 by 2025, about a year after the next BTC halving.

“The close-up below shows that this more modest supply model has been (in hindsight) more accurate than the original S2F’s projections for this halving cycle.”

Timmer says that based on the adoption of mobile phones, Bitcoin could explode in value and trade at $144,753 by 2025. But if Bitcoin follows the adoption rate of the internet, Timmer’s model suggests BTC has topped out and could trade at $47,702 in three years.

“Assuming the mobile phone curve is a more viable analog, its curve suggests a strongly growing network for Bitcoin in the years ahead, but the more asymptotic internet curve raises the possibility that perhaps Bitcoin’s growth curve is more mature than my models have assumed…

I remain bullish on Bitcoin as an aspiring store of value in a world of ongoing financial repression, but the above exercise is a good reminder that we should always revisit our assumptions, especially when the price action deviates from expectations.”

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock / Larich

Source: https://dailyhodl.com/2022/06/06/fidelity-macro-analyst-makes-long-term-bitcoin-forecast-using-new-trading-models/