A widely followed crypto analyst is lighting up a tweetstorm, warning traders that Bitcoin (BTC) has six reasons to go lower.

Pseudonymous trader CryptoCapo warnt their 315,700 Twitter followers in a six-part thread that there are reasons to believe BTC will hit new lows soon.

“BTC – Some of the reasons why I think we should see new lows in the coming days

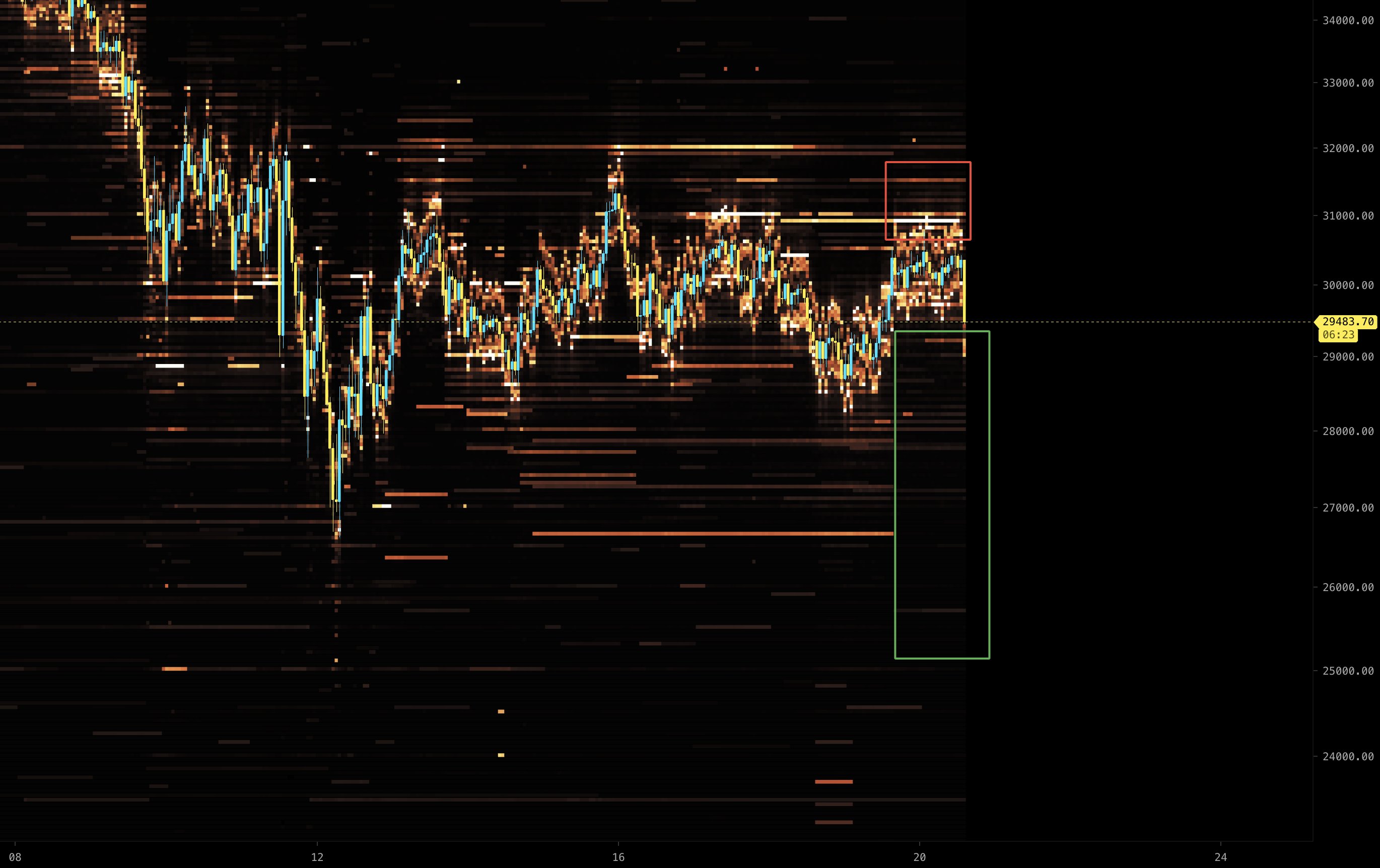

1) BTC broke the 30k support zone, which was the main pivot of the bull run. This is a zone, not a level. It’s between $29,000-$31,000, taking all the wicks. Now it’s testing that zone as resistance.”

The trader references a tweet from 10 days ago where he laid out why he didn’t think the $30,000 support level would hold for BTC.

Firwat denken ech datt den 30k Niveau net hält?

-Et gouf vill Mol getest, also ass et elo méi schwaach. Dëst ass de 5. Test

-Et gëtt net genuch Nofro op dësem Niveau (Heatmaps beweisen dëst)

-Et kënnt aus enger Ofwäichung vum Beräich héich + Bier Fändel

-Verkafsdrock ass nach ëmmer héich pic.twitter.com/pTGtsobtqv

- il Capo Of Crypto (@CryptoCapo_) Mee 10, 2022

Capo’s second reason involvéiert a bear flag signal he referenced in late-April 2022. The trader seet the bear flag minimum price level has yet to be reached, another reason to believe BTC will continue lower.

“2) The minimum target of the bear flag hasn’t been reached yet ($23,000). You can also see this on altcoins, where some of the main targets haven’t been reached yet.”

CryptoCapo next looks at Bitcoin funding rates, an asset sentiment indicator, invi- why current rates point to a bottom. He tacks on a Bitcoin open interest (OI) chart for support.

“3) Funding rates have remained neutral/positive all the time. For a bottom to form, you want to see very negative funding rates. We haven’t seen that yet.

Also, OI didn’t show a capitulation candle (no big drop on OI).”

De Krypto-Händler dann gesäit at the Altcoin Perpetual Futures Index (ALTPERP), which tracks the price of a basket of leading altcoins, including Ethereum (ETH) an.

“4) ALTPERP is in no man’s land. It broke the key level, and the next support is 35-40% lower. This matches with the main targets of most alts and it would make a lot of sense.”

Keeping an eye on stocks, Capo seet a bearish Standard & Poor’s 500 Index (SPX) combined with a bullish US Dollar Index (DXY) are bad omens for Bitcoin.

“5) SPX and DXY SPX is really bearish. It’s breaking supports like butter, and the bearish trend is getting stronger. Meanwhile, DXY keeps making higher highs and higher lows. It broke the previous highs and it’s using them as support now.”

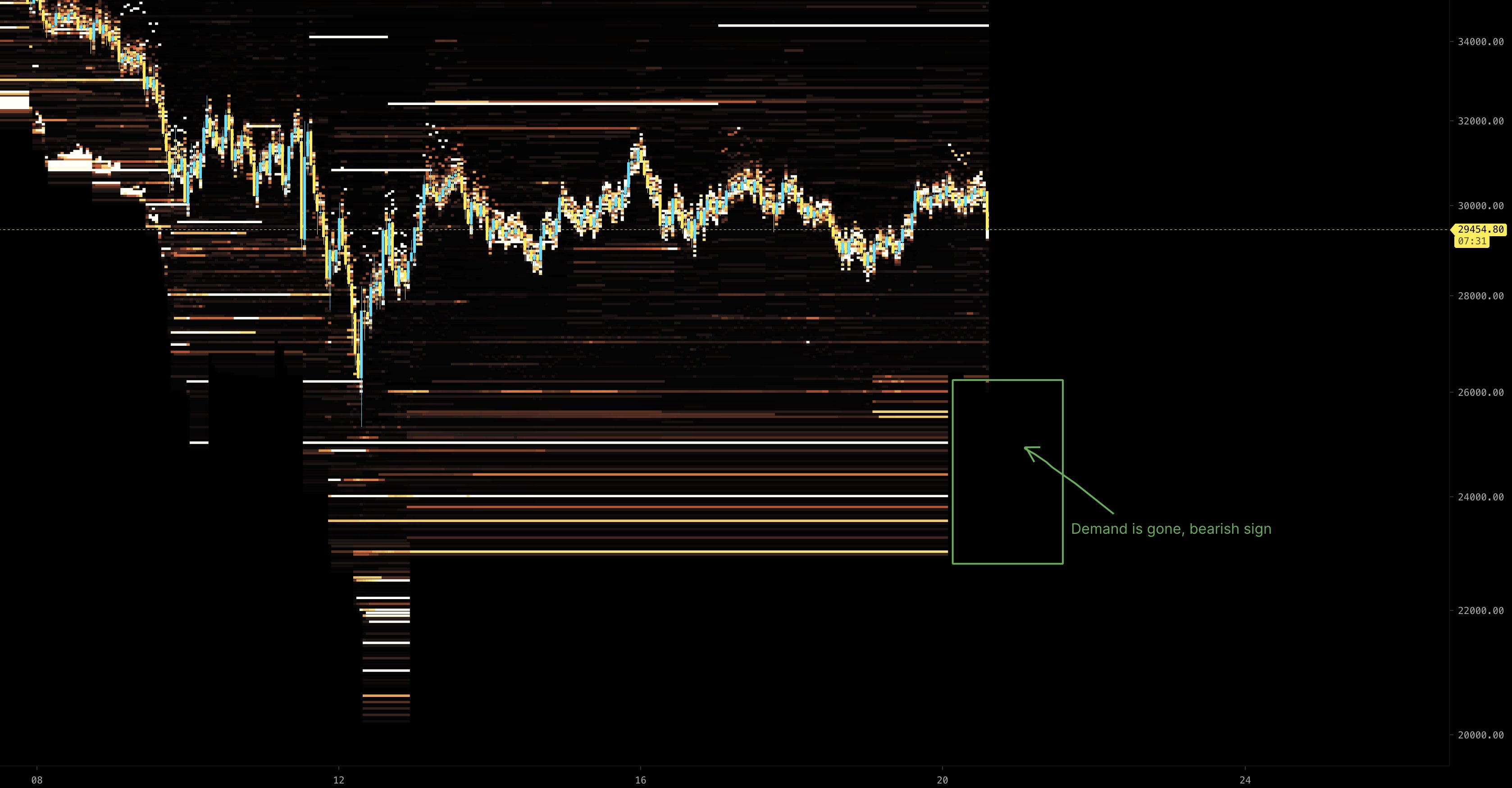

Finally, the crypto trader gesäit at BTC heatmaps, an asset liquidity indicator, as the sixth and final reason why he thinks Bitcoin will reach new lows in the coming days.

“6) Heatmaps look bearish.

You can clearly see much more supply than demand, and some of the demand is getting weaker/moving lower.

Some examples below.”

geschriwen ass am Moment vum Schreiwen fir $ 29,828 gehandelt.

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock / Digital Store / Chuenmanuse

Source: https://dailyhodl.com/2022/05/20/crypto-analyst-warns-six-factors-will-drive-bitcoin-btc-prices-lower-in-the-coming-days/