Corporate investors have grown from an insignificant part of crypto trading to now dominate, at least on US’ biggest crypto exchange, Coinbase.

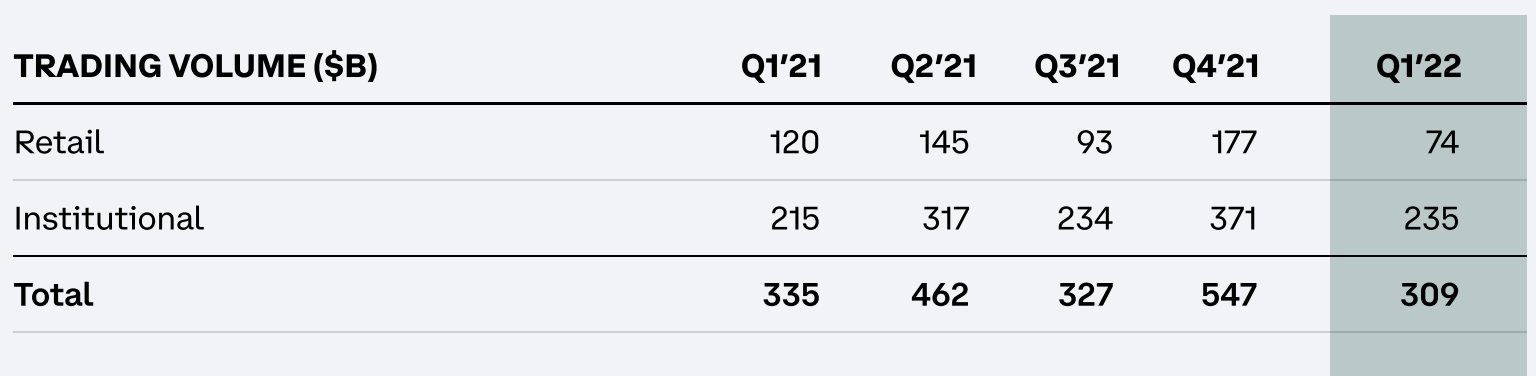

They accounted for 76% of the trading volumes in the first quarter of 2022, but this was mostly because the public kind of stopped trading.

$177 billion of trading volumes in the fourth quarter of 2021 was by the public. That plunged to just $74 billion.

At the same time corporate investors increased their trading from $234 billion in the third quarter to $371 billion in Q4 and $235 billion in Q1.

This gives some credence to the suggestion that much of the selling since November has been by corporate investors, like banks and hedge funds, rather than the public.

The same pattern of increased volumes by corporate investors can be seen in Q2 2021 as well when bitcoin also crashed, while ordinary investors reduced their trading.

Suggesting that banks and hedge funds potentially contributed to the crash, while other investors kept their cool somewhat.

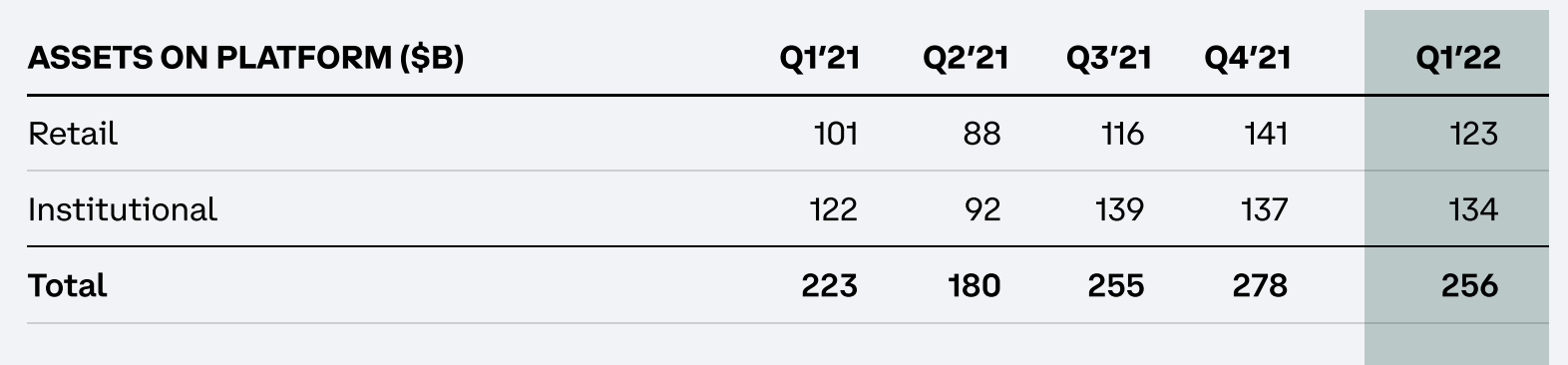

The public however continues to own much of the asset, unlike in stocks where corporate investors own some 80% of any given stock.

The public held most of the crypto assets in Q4 for that to become a 50/50 split in Q1 as corporations and the public battle out for dominance.

Where ownership is concerned, there seems to be a stalemate of sorts, but on volumes corporate investors have been gaining and gaining in great part because they seem to be hugely subsidized by Coinbase.

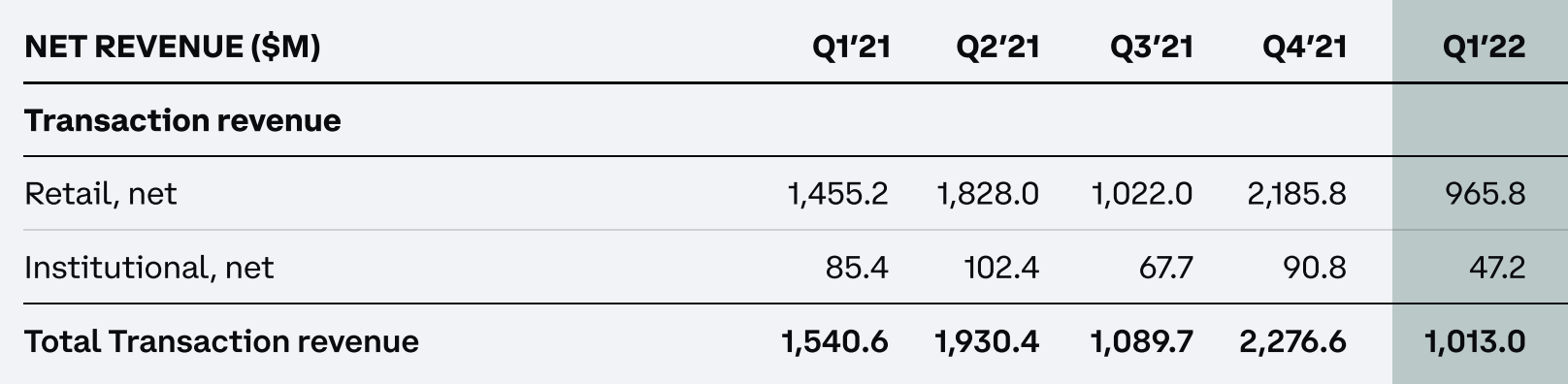

Their letter to shareholders shows that net revenue from the public rose to $2.1 billion in Q4 2021. While at the same time corporate investors paid only $90 million.

Although the public is trading on Coinbase half as much as corporate investors, they’re nonetheless being charged 10x to 20x more than the likes of banks or hedge funds.

On the surface this sounds like an extortion, with corporations getting pretty much free trading while everyone else has to account for the house rake.

Something that may fundamentally increase the ownership share by corporations simply because they’re not giving billions to Coinbase.

Raising the question as to why there’s this huge discrepancy, while easily answering the question as to why there’s this dominance in trading by corporate investors.

Because they can do it for pretty much free as Coinbase is forcing the public to subsidize them even while these very corporate investors may be sparking these crashes.

A decision that doesn’t seem to make very much economic sense because they clocked a net loss of close to half a billion for Q1.

As you’d expect because they’re not charging the entities that perform most of the volumes, rigging the game in the process while causing losses to themselves with no apparent good reason.

Source: https://www.trustnodes.com/2022/05/30/corporate-investors-now-dominate-bitcoin-trading