Bloomberg Intelligence senior commodity strategist Mike McGlone says the crypto market crash recently reached extreme levels.

McGlone seet Bitcoin (BTC) recently traded at the steepest discount since the computation of the flagship crypto asset’s 200-week moving average began.

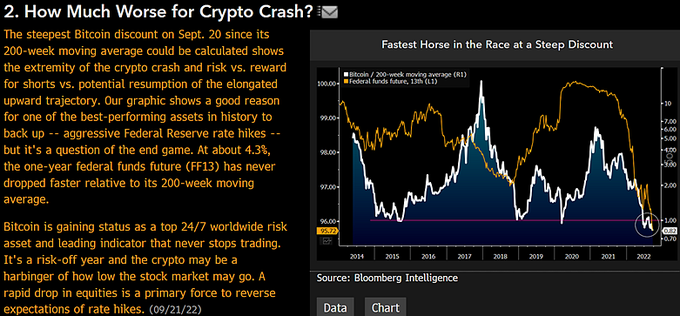

“The steepest Bitcoin discount on September 20 since its 200-week moving average could be calculated shows the extremity of the crypto crash and risk vs. reward for shorts vs. potential resumption of the elongated upward trajectory.”

According to the Bloomberg Intelligence strategist, the aggressive interest rate increases by the U.S. Federal Reserve offer a “good reason” for Bitcoin to reverse the downward spiral.

“Our graphic [below] shows a good reason for one of the best-performing assets in history to back – aggressive Federal Reserve rate hikes – but it’s a question of the end game. At about 4.3%, the one-year federal funds future (FF13) has never dropped faster relative to its 200-week moving average.”

The federal funds future is a derivative based on short-term interest rates as set by the Federal Reserve. Investors use the derivative to bet or hedge against the fluctuations in the short-term interest rate.

On the crypto market correlation with stocks, McGlone says that Bitcoin and other crypto assets could determine the stock market bottom.

“Bitcoin is gaining status as a top 24/7 worldwide risk asset and leading indicator that never stops trading. It’s a risk-off year and the crypto may be a harbinger of how low the stock market may go. A rapid drop in equities is a primary force to reverse expectations of rate hikes.”

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

kontrolléieren Präis Action

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock/Zaleman

Source: https://dailyhodl.com/2022/09/23/bloomberg-analyst-says-bitcoin-just-traded-at-steepest-discount-ever-heres-how-btc-can-reverse-course/