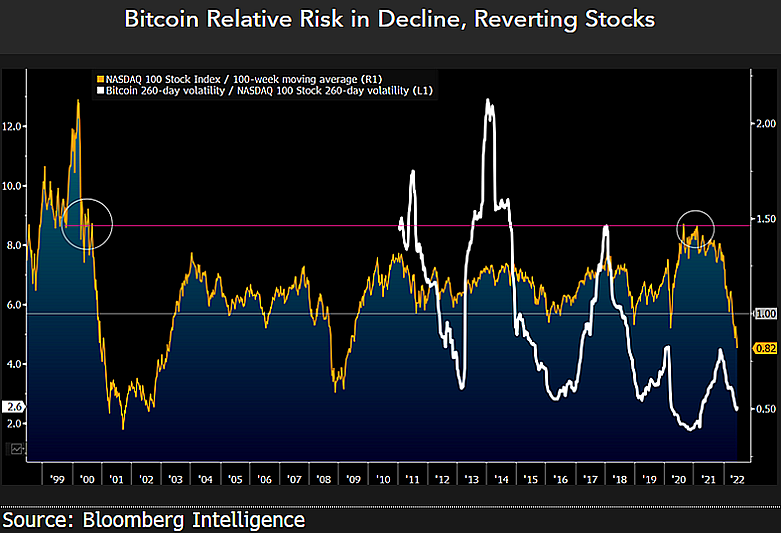

Bloomberg’s senior commodity strategist Mike McGlone says a new deflationary period may be arriving to the financial landscape, from which Bitcoin (BTC) and gold could benefit.

The analyst tells his 47,700 Twitter followers that plummeting risk-on assets may evolve into a deflationary phase that boosts the flagship cryptocurrency, the yellow metal and US bonds.

“Too Hot Stocks vs. Maturing Bitcoin? Plunging risk assets in 1H [first half] are taking away inflation at a breakneck pace, which may translate into pre-pandemic deflationary forces resurfacing in 2H [second half]. Primary beneficiaries of this scenario may be gold, Bitcoin and US Treasury long-bonds.”

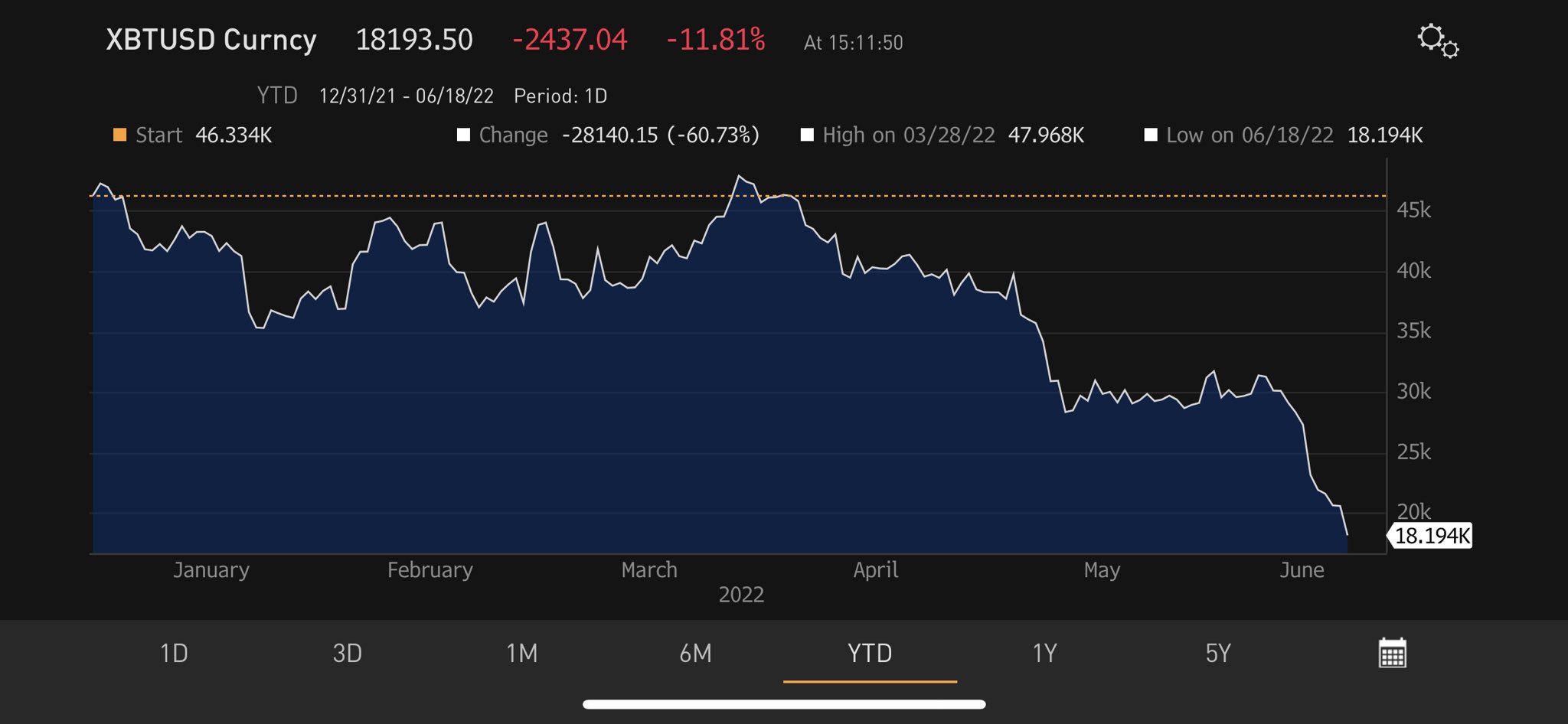

As Bitcoin continued dipping over the weekend, McGlone predicted that this week would see even more declines in risk assets. He says the big declines could reduce the need for the Federal Reserve to maintain its stance on monetary tightening.

“Down over 10% on Saturday, Bitcoin pointing to a big risk asset decline week. Feds 75 bps [basis points] hike may be the last, risk asset deflation doing the tightening for them. 1929ish – aggressive rate hikes despite plunging stock market, global GDP and consumer sentiment.”

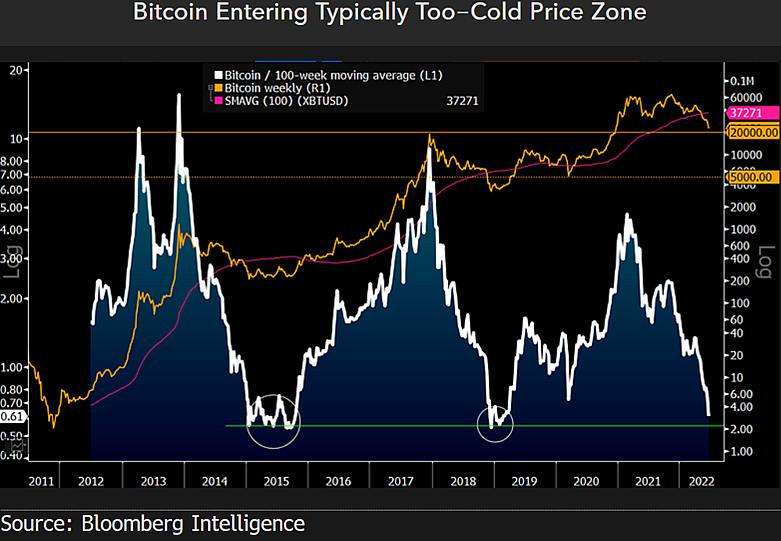

Last week, the Bloomberg analyst gesot that the $20,000 level for Bitcoin could be the new $5,000.

During the 2018 bear market, the $5,000 price area served as support for Bitcoin for about a year. In 2020, the $5,000 level also acted as support for Bitcoin even though BTC briefly breached the area a couple of times.

"$ 20,000 Bitcoin kann den neien $ 5,000 sinn - De fundamentale Fall vu fréien Deeg fir d'global Bitcoin Adoptioun vs. Ofsenkung vun der Versuergung kann duerchsetzen wéi de Präis typesch ze kale Niveauen ukommt. Et mécht Sënn datt ee vun de bescht performante Verméigen an der Geschicht géif erofgoen [déi éischt Halschent vun 2022].

kontrolléieren Präis Action

Verpasst kee Beat - abonnéieren fir Krypto E-Mail Alarmer direkt an Är Inbox geliwwert ze kréien

Follegt eis op Twitter, Facebook an Hëllefe profitéieren

Surfen Den Daily Hodl Mix

Disclaimer: Meenungen ausgedréckt am The Daily Hodl sinn net Investitiounsberodung. D'Investisseure sollten hir Due Diligence maachen ier se héich riskéiert Investitiounen an Bitcoin, cryptocurrency oder digital Verméige maachen. Gitt u Berodung datt Är Transferen an Trades op Ären eegene Risiko sinn, an all Verloscht déi Dir leet, ass Är Verantwortung. Den Daily Hodl empfeelt net de Kaf oder de Verkaf vu Krypto-Währungen oder digital Verméigen, an och ass den Daily Hodl keen Investitiounsberoder. W.e.g. notéiert datt den Daily Hodl am Partnermarketing matmaacht.

Featured Image: Shutterstock / Art Furnace

Source: https://dailyhodl.com/2022/06/21/bloomberg-analyst-says-bitcoin-and-gold-could-benefit-from-potential-incoming-deflationary-phase/