Bitcoin Analyse

Bitcoin’s price was controlled by bullish market participants on Monday and after BTC traders had settled up on the day BTC’s price had climbed +$1,939.9.

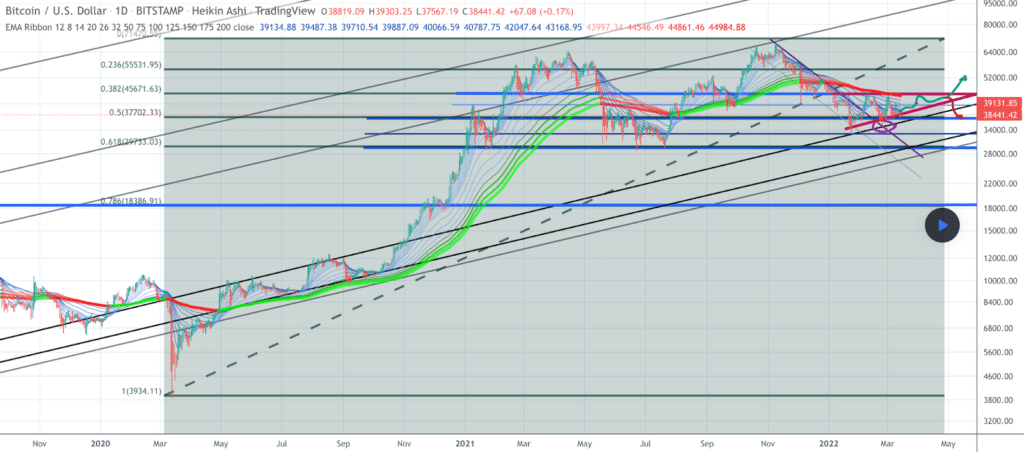

Déi éischt Grafik déi mir haut analyséieren ass den BTC/USD 1D Diagramm hei drënner vun shri2222. BTC’s price is trading between 0.5 fibonacci level [$37,702.33] and 0.382 [$45,671.63].

From the perspective of bullish BTC traders, they’re aiming to crack the 0.382 fib level and will shift their focus if successful there to 0.236 [$55,531.95]. Bullish BTC market participants have a third target of the $70k level near the peak of BTC’s all-time high.

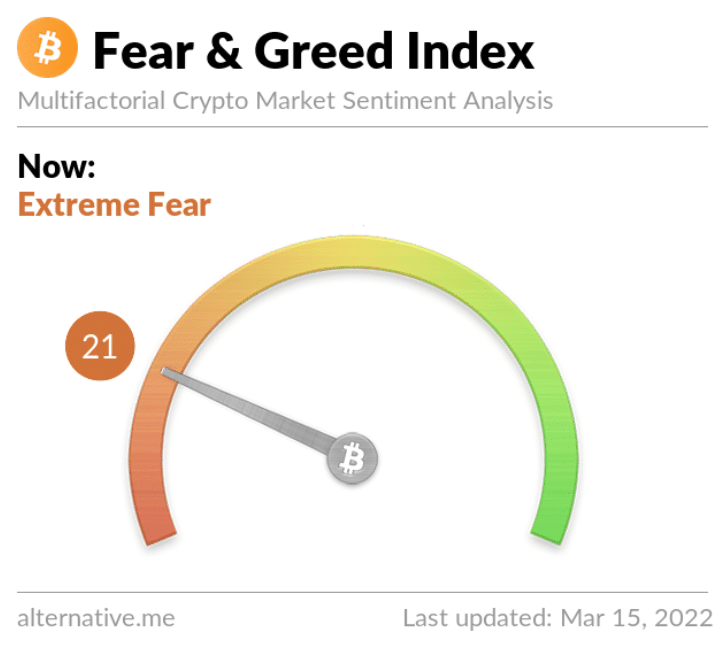

Den Angscht a Gier Index ass 21 Extreme Fear and -2 from yesterday’s reading of 23 Extreme Fear.

D'Bewegungsduerchschnëtt vu Bitcoin: 5-Dag [$39,507.12], 20-Day [$40,255.22], 50-Day [$40,704.04], 100-Day [$48,024.74], 200-Day [$45,696.73, Joer bis 40,808.36, XNUMX].

BTC’s 24 hour price range is $37,709-$39,717 its 7 day price range is $37,387-$42,438. Bitcoin’s 52 week price range is $29,341-$69,044.

De Präis vun Bitcoin op dësem Datum d'lescht Joer war $55,805.

The average price of BTC for the last 30 days is $40,025 [-7.9%].

Bitcoin Präis [+5.14%] zougemaach seng deeglech Käerzenhirstellung $39,717 and in green figures again on Monday after closing Sunday’s daily candle in red figures.

Ethereum Analyse

Ether Präis also made its way higher op de Méindeg an ofgeschloss seng deeglech Sëtzung + $ 72.55.

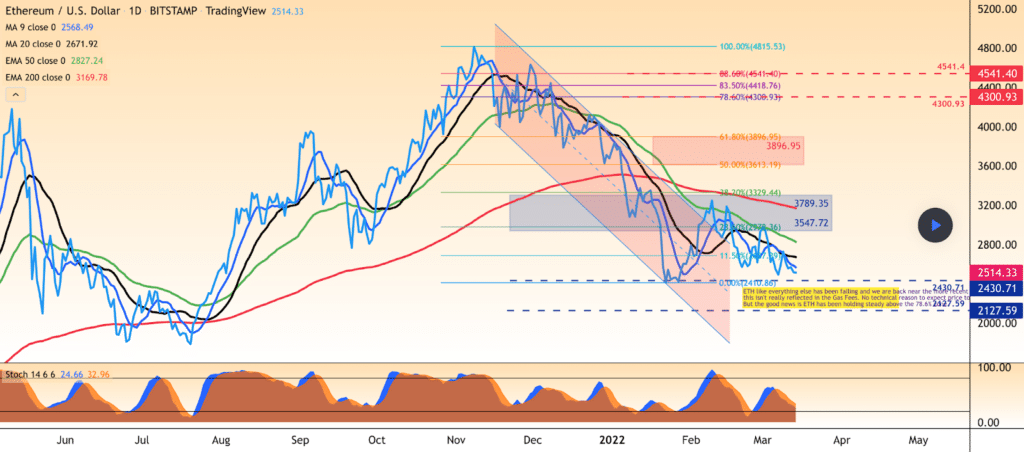

The second chart we’re looking at for Tuesday is the ETH/USD 1D chart from stikytrading. Ether’s price is trading between 0.00% fib level [$2,410.86] and 23.60% [$2,978.36].

The primary overhead target for bullish Ether traders is the 23.60% fib level. If they overcome the 23.60% level, the next target is 38.20% [$3,329.44] with a third target of 50.00% [$3,613.19].

Conversely, bearish Ether market participants are looking to snap the 0.00% fib level that may inevitably lead to a retest of the $2k level.

Ether d'Moving Moyenne: 5-Dag [$2,603.39], 20-Day [$2,736.76], 50-Day [$2,891.24], 100-Day [$3,561.67], 200-Day [$3,220.59$.], Joer bis Datum.

ETH's 24 Stonnen Präisbereich ass $ 2,513- $ 2,605 a seng 7 Deeg Präisbereich ass $ 2,467- $ 2,760. Dem Ether seng 52 Woche Präisbereich ass $ 1,558- $ 4,878.

De Präis vun ETH op dësem Datum am 2021 war $ 1,791.

The average price of ETH for the last 30 days is $2,722 [-11.8%].

Ether Präis [+2.88%] closed its daily candle on Monday valued at $ 2,589.30.

Litecoin Analyse

Litecoin rallied [+$4] with much of the crypto market on Monday and bullish Litecoin market participants sent LTC’s price back above the $105 level.

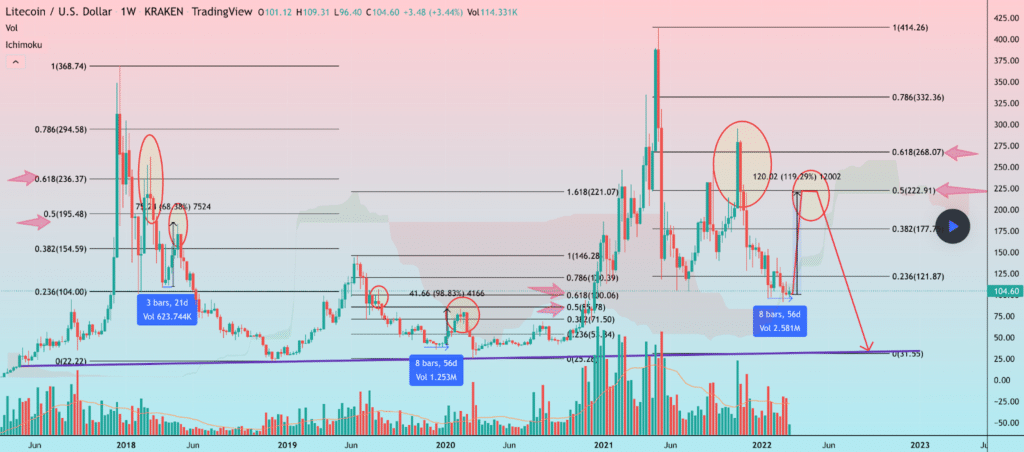

The LTC/USD 1W chart below from CRYPTOPICKK shows LTC’s price trading between the 0 fib level [$31.55] and 0.236 [$121.87], at the time of writing.

Bullish Litecoin traders are seeking to break the 0.236 with a secondary target of 0.382 [$177.75] and a third target of 0.5 [$222.91].

Litecoin’s Moving Averages: 5-Day [$103.45], 20–Day [$109.13], 50-Day [$119.67], 100-Day [$154.65], 200-Day [$157.30], Year to Date [$120.21].

The price of LTC is -51.9% against The U.S. Dollar for the last 12 months, -26.45% against BTC, and -65.35% over the same duration.

LTC’s 24 hour price range is $101.43-$105.83 and its 7 day price range is $97.47-$108.67. Litecoin’s 52 week price range is $91.7-$410.26.

De Präis vun Litecoin op dësem Datum d'lescht Joer war $ 200.92.

The average price of LTC over the last 30 days is $108.98.

Litecoin Präis [+3.93%] zougemaach seng deeglech Sëtzung Wäert $105.7 and in green figures for the fifth time over seven days.

Source: https://en.cryptonomist.ch/2022/03/15/bitcoin-ethereum-litecoin-price-analyses/